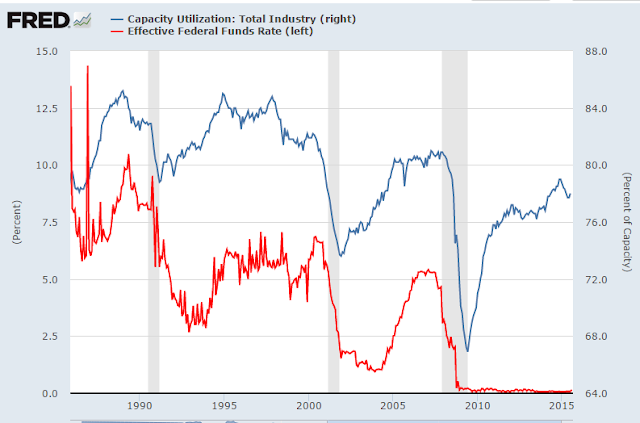

Still other stunned dunces, decoupled from reality, decry this non-stop "Keynesian" intervention: 35 years of papering over trade deficits using ever cheaper money and ever more debt. Never once admitting that the trade deficit is any part of the underlying problem. Always looking at the symptom versus the cause. Too in love with Walmart to admit that there's no such thing as a "jobless consumer". Why can't all of the wage slaves just be happy at $1/hour aka. the "free market" wage? We all know that wouldn't affect corporate revenue much - already tanking dollar for dollar with the middle class, while boy-men wonder why.

Holy fuck. Keynes never predicted so many retards in one place at one time.

As indicated recently, Globalization is a market that will NEVER EVER clear, even the U.N. admits as much:

The U.N. Conference on Trade and Development [2013]:

http://unctad.org/en/pages/PublicationWebflyer.aspx?publicationid=636

"Five years after the onset of the global financial crisis the world economy remains in a state of disarray. Prior to the Great Recession, buoyant consumer demand in the developed countries seemed[?] to justify the adoption of an export-oriented growth model by many developing and transition economies. But that expansion was built on unsustainable global demand and financing patterns. Thus, reverting to pre-crisis growth strategies cannot be an option."

Versus this quaint idea:

Even a barter economy would be better than the current clusterfuck. Which is good, because that's where we're headed.

Today's stunned dunces are all going to find out at the exact same time, that they're just stunned dunces.