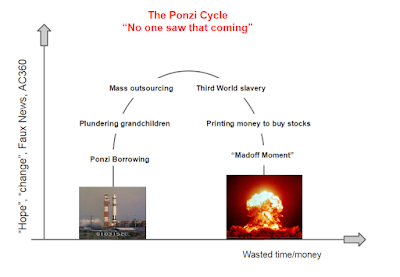

This six year multi-trillion risk asset rally was a Centrally Planned Momentum feedback loop. Central Banks and HFT algorithms provided the ignition fuel, and then greed and misallocation of capital took over...

Momentum begat momentum. This entire era took on a life of its own, complete with self-rationalizing 24x7 non-stop bullshit, to justify the asinine risk taking. Any time momentum stalled, more Central Bank dopium would rush in. There was never any exit strategy, as we see every day in China.

Those caught up in this last bubble - aka. everyone, started to believe their own bullshit. Throwing all of their money at the casino, which in turn levitated their fake wealth. Causing them to throw more money away...

Remember this?

ZH: Dec. 31st, 2014

Hugh Hendry: I Am Taking The Blue Pills Now

"There are times when an investor has no choice but to behave as though he believes in things that don't necessarily exist. For us, that means being willing to be long risk assets in the full knowledge of two things: that those assets may have no qualitative support; and second, that this is all going to end painfully...China is set to record its weakest growth in GDP in 25 years. Yet it seems to have entered a bull market and may be where we deploy much more of our risk capital next year. That's because the recent exuberant run up in onshore Chinese equities seems to me to amply demonstrate the power of imagined realities."

Since China ran into the brick wall of reality, momentum worldwide has stopped and now reversed:

Abrupt momentum reversal visualized:

Shanghai Comp. and Dow

Momentum globally is now building up in the opposite direction. Slowly at first, but since the Yuan devaluation, picking up notable acceleration to the downside.

Sooner rather than later, it will become out of control to the downside. And it will drill this imagined reality deep underground. We've had ample warning.

Aussie / Yen Carry Trade:

"Mo in. Mo out"

Momentum in. Momentum out