Any questions?

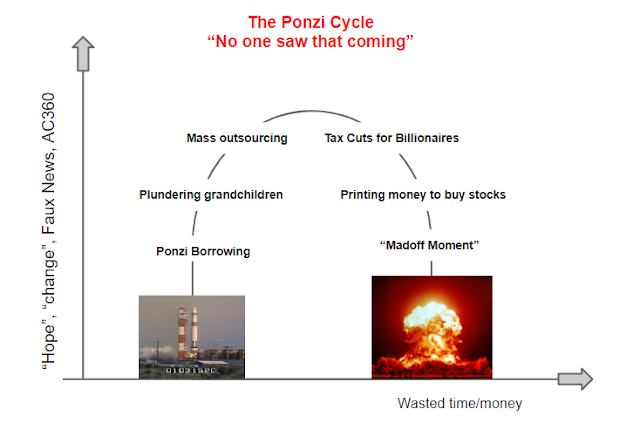

It's entirely fitting that an exploitative society exhibiting the debased values of a Third World refugee camp, would have no clue that their exploitation scheme is ending.

The standard assumption in every ponzi scheme is to assume that someone else is getting fucked over, not oneself.

The paradigm shift from active to passive investing, was attended by obligatory mass ignorance and the mantra that "there is no alternative", to stocks. Fast forward and now the dumbfuck bubble has become the biggest bubble in human history. In other words, artificial intelligence is rampant. This should properly read "how AI won't manage your money". For one thing, the "sell" feature will be programmed to automatically remind sheeple why that's a bad idea.

No surprise, the once mighty are now falling. One by one the biggest hedge fund gurus are getting taken to the woodshed. Victims of the dumbfuck bubble. In this society every IQ point above 5 is a liability to one's sanity and P&L.

John Paulson, David Einhorn, Hugh Hendry, Kyle Bass, this week it was Bill Ackman's turn. Bill was one of the few hedge fund managers who had the brass to take his fund public. Where all the world could see how well he's doing. And then front-run his positions when the redemptions rolled in.

This society has a collective IQ of 5. Today's "best and brightest" PhD thought dealers are as dumb as a fucking post. Which was the first of many lessons not learned in 2008. To begin with, in a pseudo-economy consisting of Supply and Debt, stock market P/E ratios have the veracity of a Chinese fortune cookie. Forward profit estimates have a bad habit of turning back into pumpkins at the end of the cycle. Corporate profits went from all time highs in 2007 back to 1975 lows in 2009. ALL of the new McJobs created during the eight Bush years were gone in nine months. As if there had been no recovery.

Dumber still, these dunces used balance sheet expansion aka. printed money to artificially inflate asset values. Because printing money was their secret to effortless wealth. Now however, the Fed is reducing their balance sheet at the fastest rate in history - $30 billion per month. Which is 50% faster than in Q1 which was the first down quarter for the casino since 2015. So now they're ratcheting up the pace.

What then is the new curriculum in Macroeconomics - optimal money printing to inflate Netflix? ETF trading for central bankers?

There was a point in time when "there was no alternative", but now cash is yielding more than the S&P 500, so this entire scam is now 100% zero sum ponzi scheme. Gamblers missed the offramp, thanks to the eminently corrupt financial services industry.

What then is the new curriculum in Macroeconomics - optimal money printing to inflate Netflix? ETF trading for central bankers?

There was a point in time when "there was no alternative", but now cash is yielding more than the S&P 500, so this entire scam is now 100% zero sum ponzi scheme. Gamblers missed the offramp, thanks to the eminently corrupt financial services industry.

Add in a few other widely ignored issues such as global synchronized slowdown. Fed rate hikes. Global trade war. Record high volatility. Not to mention the nutjob-in-chief. All wrapped up with mass complacency.

Unfortunately, for this stoned Idiocracy, a Black Swan event doesn't consist of things that are taking place in broad daylight. What's already happened doesn't meet the standard definition of a rare and unforeseeable event.

"Has monetary policy aided and abetted risk-taking? I hope so. That's why we did it"

Anthony Haldane, Bank of England, July 13, 2014

And that's why we're undoing it:

The mandatory delusion is that no one knows what will happen with Fed rolloff. But even that is a massive fabrication. QE1 and QE2 both culminated in balance sheet rolloff. Because back then the Fed wasn't automatically rolling over their holdings.

Any questions?

Remember back in 2011 when Gold made its parabolic run which ended with QE2 rolloff? In this part of the cycle, the new safe haven from "fiat" was Bitcoin, which imploded concomitant with the rolloff of QE4.

For all of the ever-shifting reasons Bitcoiners have proferred for owning Bitcoin - digital currency, safe haven, store of value, etc. etc., it never once occurred to them that Central Bank muppet was the only real one.

In other words, implosion is now on auto-pilot. Like this society of zombies.

The brainwashed fools who believe they can ride out another Great Depression are blissfully unaware that it took 25 years for the stock market to recover back to 1929 levels.

This is going to be a lesson that they will never forget. When they realize their thought dealers are dumber than they are, the underwear will be stained.

But let's not forget, our dumbed down thought dealers were hand-picked for a reason. Who else would tell us we could borrow our way out of a debt crisis?

But let's not forget, our dumbed down thought dealers were hand-picked for a reason. Who else would tell us we could borrow our way out of a debt crisis?

That will be the final lesson - when looking for a carnival barker to lead the way, you can always find one, ready and willing.

Which begs the inevitable question. The fool or the one that follows?