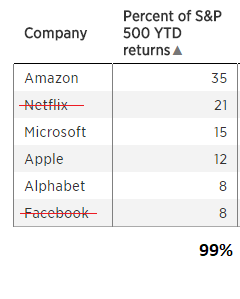

Of the last four FOMC meeting's (Jan, Mar, May, Jun), the May 1st meeting was the only meeting that led to an S&P rally versus selloff. That is the meeting that coincided with the announcement of Apple's mega stock buyback. Basically one stock drove a three month rally on ever-imploding breadth:

This is exactly how 1929 ended - record wealth inequality and an oblivious casino class. Trump is what happens when a robber baron dunce born on third base strolls home and thinks he made a home run. He's not the beginning, he's the end:

This shows how stocks have kept rising despite stagnant revenues. Keep squeezing the middle class. Globally:

Data from: https://us.spindices.com/indices/equity/sp-500

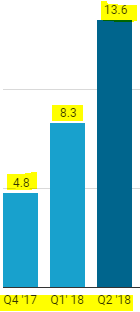

Despite zero growth in handset volume - and below Wall Street's low expectations - Apple still grew profit, via sales of the higher priced iPhone 10 and of course human history's largest stock buyback program:

Apple closed at $190 prior to their earnings report. $203 is the $1 trillion number. A reversal at these levels is game over for Tech, the S&P 500, and the globalized Ponzi scheme. Given that there were zero new highs in Tech land today:

For Apple suppliers, the news of zero unit growth year over year, is not good.

Nor is this news that broke after hours:

"The Trump administration will propose raising to 25 percent its planned 10 percent tariffs on $200 billion in Chinese imports"

In summary:

They were amply warned: