Remember when the Fed raised interest rates 17 times in a row back in 2005-2007 thus imploding the housing bubble? That's what they're doing right now. The difference is that today the sheeple are in mass denial, so everyone is too busy pretending it's not happening, to object.

Ah, good times.

Below, this consumer credit delinquency data from the Fed's own website is seven months old. In the meantime, short-term rates have marched relentlessly higher. So borrowing a trick from the EconoDunce profession, I have extrapolated delinquencies into the future, meaning now. What we notice is that even if I don't extrapolate, the absolute value of delinquencies is at mid-2008 levels. Extrapolation gets us to Lehman level delinquency rates.

Of course linear extrapolation is often a fool's errand, because if we notice, interest rates hit a cycle high of 5% in 2007 whereas at the same level of defaults as 2007 i.e. one year ago, rates were at .66%, indicating a 600% increase in sensitivity to interest rates in this cycle. Compliments of 0% for eight years.

What we also notice, looking at interest rates above, is that there was a late cycle blip upwards in the short-term market yield. However, due to the various dominoes falling at the time, the Fed never blinked and kept a steady hand on lowering the Fed Rate (not shown). But why then did market rates rise into the "event"?

We know the answer of course:

August 14, 2008:

"The biggest culprit in driving up inflation was the cost of energy, which increased by 4% on a monthly basis and 29.3% annually."

Fast forward to now:

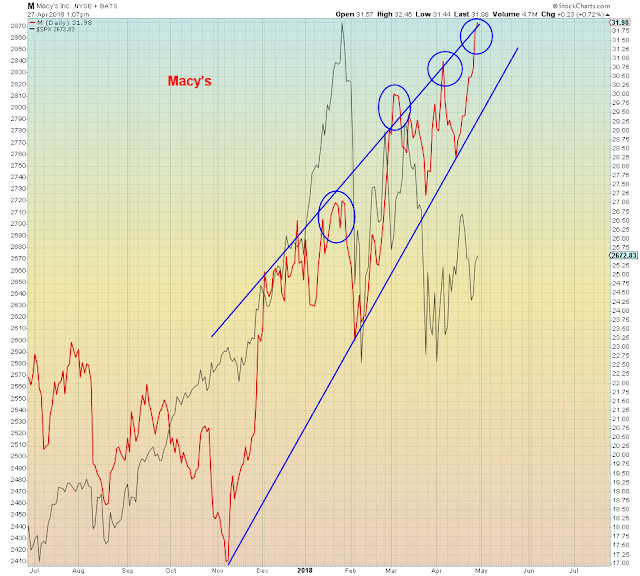

Crude oil versus delinquencies (red):

There is one major difference between now and 2008:

The difference of course is that this time around the Fed is considering increasing their late cycle tightening, not decreasing it.

It's a two pronged attack:

Balance sheet tightening which is on auto-pilot mode of increasing rolloff rate with each passing quarter:

And of course interest rate tightening

Is anybody home?