Moral Hazard: "In economics, moral hazard occurs when someone increases their exposure to risk when insured. This can happen, for example, when a person takes more risks because someone else bears the cost of those risks"

I just watched a new movie on Netflix (and in theaters) on Chinese IPO fraud propagated via U.S. financial markets...

The fraud itself is very straightforward and overtly corrupt: Companies based in China cannot be investigated by the U.S. SEC, so their U.S.-filed financial statements are taken at face value. Meanwhile, the "Big Four" accounting firms have branch offices based in China whose audits are essentially corrupt and worthless. Which is deja vu of the ratings agencies in 2008s subprime debacle. So, for example, "PWC" may give its imprimatur to China Corp. but the audit findings are meaningless. The company may not even have employees. In addition, the Chinese government has a policy of never prosecuting fraud perpetrated on foreign investors. Which means that ALL U.S. listed Chinese IPOs - currently in the neighbourhood of $1.1 trillion - could be fraudulent to lesser or total degree. No one knows.

The documentary starts out by describing ~300+ reverse mergers that took place in the immediate aftermath of the subprime collapse. These were Chinese companies that were merged with near-defunct U.S. companies, so they could skip the IPO process. The U.S. companies were already listed. These were almost entirely frauds.

Most of these reverse merger companies have already been delisted to the tune of ~$50 billion in investor losses, but here is one for example:

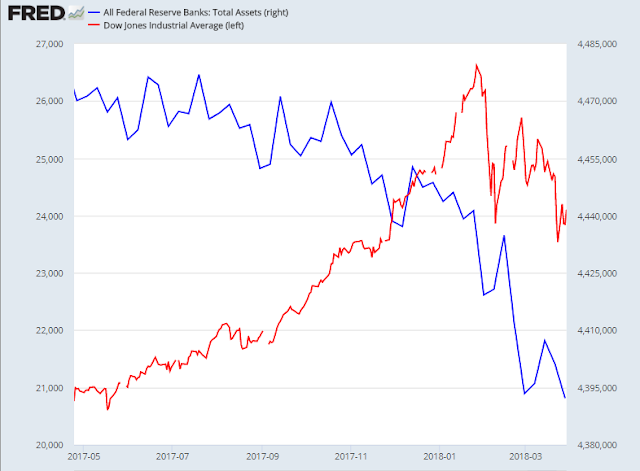

We see that this new fraud was hatched in the throes of the global financial crisis

Last week alone, fully 50% of the (8) IPOs were China-based companies.

What this points to is systemic fraud in the U.S. stock market imported from China and ignored by the SEC, the Big Four accounting firms, Wall Street, and investment advisors.

And yes, the bubble is bursting.

But really, in a post-bailout anything-goes nihilistic Idiocracy, chasing revenueless Biotech, value-less crypto-currencies, over-hyped FANG stocks, and condo flipping,

What's one more fraud?