Before anything can change, the first step is for the usual sociopaths to get monkey hammered. For good:

Look in any direction - academics, business, economics, politics, media - they're all proven failures now. Corporate whores tasked with maintaining the illusion of the status quo at any cost. Today's best and brightest have run out of stupid fucking ideas. What happens when the zombies wake up and realize their leaders are as dumb as they are? Nothing good: "Hey, I thought I was the fucking moron around here".

One more day left in 2018, and is it coincidence that the Santa rally arrived just in time to stave off meltdown prior to bonus payout? Probably not.

The Santa Trump rally began on December 26th and so far indicates a three wave correction off of the December low. As we see below, these past two weeks since the rate hike have featured the two most volatile days since February. One to the downside post rate hike, followed by one to the upside this past week. Skynet is losing control.

Speaking of rallying off the December low, here we see below that the S&P bounced at the 200 week moving average which hasn't been breached for seven years. Also, we see in the lower pane that realized volatility far exceeds February VolPlosion, and eclipses 2008 on an absolute basis - albeit not on a % basis.

Deja vu of 2008 there was a dip in volatility over the summer followed by a renewed surge in Fall:

What gamblers apparently have forgotten is that there was a Santa rally back in late 2015 as well, post Fed rate hike. But then for some reason post-bonus payout, the market went bidless in the first two weeks of January, -15%.

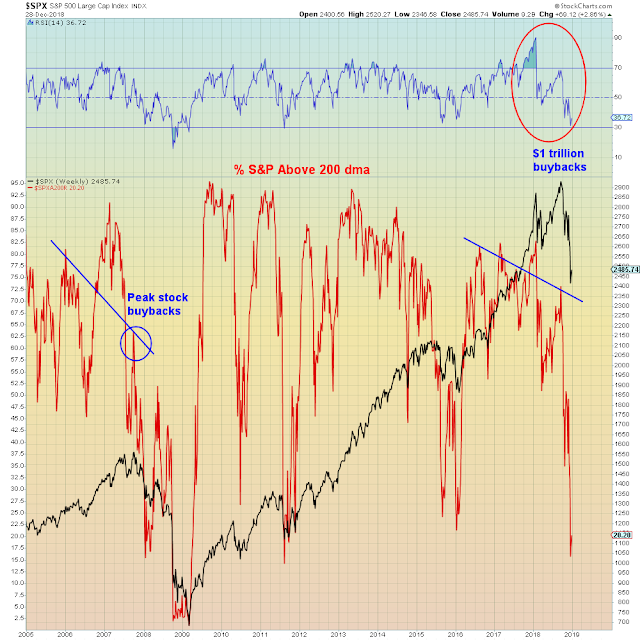

The difference this time is in far more optimistic positioning (top pane). And breadth implosion (lower pane):

The difference this time is in far more optimistic positioning (top pane). And breadth implosion (lower pane):

Breadth is worse than 2016 and remains pinned at crash levels:

Worst since 2008:

CNBC: Stocks Close Out Worst Year In A Decade

Bueller?

As long as Wall Street gets paid, that's all that matters.

For the next 48 hours.

Interestingly, there were two big pot stock rallies this past year, which exactly coincided with new all time highs in the S&P. Go figure.

Bait and switch. Pump and dump. Bull trap.

Call it what you will. It was epic.

This was the widely believed delusion that trapped gamblers in the casino:

August:

September:

SEC Commissioner:

"We give stock to corporate managers to convince them to create the kind of long-term value that benefits American companies and the workers and communities they serve...Instead, what we are seeing is that executives are using buybacks as a chance to cash out their compensation at investor expense."

The hook was set in November with this widely believed statistical delusion:

"Eighteen out of 18 times, the S&P was higher from the October low close — up just over 10 percent on average,"

The end of year result: -15% off the highs

"For the first time ever, the S&P 500 will end the year with a loss after being positive for the first three quarters...The fourth-quarter sell-off flies in the face of history, as the last three months are typically the strongest time of the year for the markets."

What trapped gamblers have to look forward to in January:

ECB To End $2.95 Trillion Stimulus Program In January

"Our work is done here"

In summary, the year is ending the same way it started.