Amid record wealth inequality, the casino class have bet everything on a tax cut for themselves. What else?

There have been three reflationary periods in this cycle. The first lasted five years, the second lasted one year, and this latest one lasted six weeks. One can make the case that the next economic cycle will not last longer than :15 minutes, pending imaginary tax cut...

"Buy the rumour, sell the clusterfuck"

Deja vu of 2008, institutions are ignoring risk and picking up yield pennies in front of the steamroller. Heads they win. Tails the system crashes again. Most of today's home gamblers haven't been through a bubble and bust, and the ones who have are stoned on fentanyl. Anyways how would you warn them, they don't trust anyone who can be trusted.

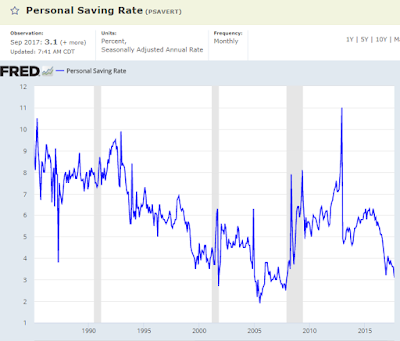

The personal savings rate is the lowest since the 2007 market top/recession, and consumer confidence is the highest since Y2K top/recession. Something else to ignore...

The reason why passive index investing always self-implodes is because it's inherently momentum investing, contrary to what Jack Bogle would like us to believe. Index investing allocates inflows based upon market cap - the largest flows go to the largest stocks. Stop me any time. Over time, the largest stocks become disproportionately oversized within the index. There is no inherent mechanism to redress this imbalance. An efficient market would allocate capital based upon under-valuation. Index investing allocates capital based upon over-valuation.

It's called dumb money. For a reason.

"pension funds and insurance companies are venturing into riskier types of investments to gain income"

"While we applaud this warning from the IMF, it’s absurdly belated and the short vol “horse” has long since bolted. Moreover, we think that the IMF is seriously under-estimating the magnitude of short vol risk in financial markets...Artemis estimates that financial engineering strategies that are short vol, either explicitly or implicitly, amount to more than $2 trillion."

Take away the outlier year 1944, and ~90% of the calmest periods ever, just occurred in the past three years, compliments of the Central Bank Jedi Mind Trick...

"It's the new six sigma permanent plateau. Bet everything accordingly"