Fakest economic numbers in years, lowest employment participation in 40 years, real wages declining, border insecure, mad WH chaos. Anyone who believes this guy deserves their fate...

Speaking of revenueless Biotech, here is the revenueless S&P 500 through Q1, inflation-adjusted.

Due to a lack of revenue growth following nine million jobs getting obliterated in 2009, this entire cycle was cost-cutting. Which works fine when one company does it, but when they all do it simultaneously, it leads to a further lack of revenue. Only they haven't figured it out yet.

Supply-Side-Dumbfuck-o-Nomics is imploding:

The two largest spikes in volatility in the past six years both occurred in August. One occurred in early August (2011), and the other late August (2015). Last week's record low VIX signal(led) that the market is pricing in record low volatility for the next 30 days. Meaning that anything outside of non-existent volatility is not "priced in"...

In other words, machines (and humans) are very good at predicting the past, but not so good at predicting the future.

What gamblers need is a better Magic 8 ball...

Don't trust the VIX anymore?

Fair enough

It's been nine months since the election, which is the longest stretch of buying the dip since 2009:

I noticed that the casino is tracing out a very similar pattern to last Fall leading up to the election. Rotation to junkier and junkier stocks. For starters, please see first chart above again.

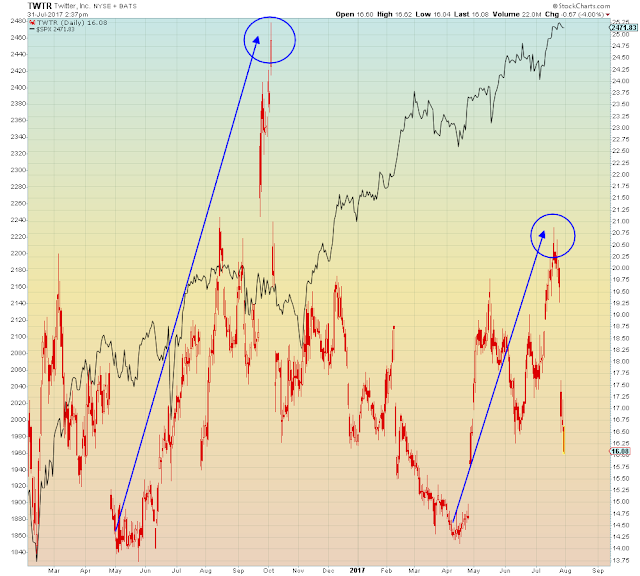

It was the TwitterTard-in-chief who brought this pattern to my attention:

Aside from Chinese internet stocks which may or may not represent real companies, the most speculative stocks in the U.S. market are small Biotech.

This is the clinical trials ETF. Many of these companies don't even have revenue yet. As we see it peaked last Fall prior to the election:

Here is one of the Biotechs in that ETF that has no revenue:

Box is a corporate internet storage company that has -35% profit margins, meaning they sell dollar bills for 65 cents...

The Bitcoin Trust fund is clinging to the 50 day:

And I would be remiss in pointing out that Facebook peaked last:

Amazon is now (slightly) below the 50 day...