Everyone is on the wrong side of the boat. The next piece of bad macro data that comes along, they're fucked company. Stampeding out of high beta junk stocks into a no bid market...

Do you know why Bernie Madoff got caught? Because he forgot that he was running a Ponzi scheme, so like a dunce he stayed to the end until it imploded. Likewise, today's stoned geriatrics just assume that their kids are the ones who are going to get shafted, with more Ponzi tax cuts for the ultra wealthy and other intra-generational plundering; little do they know they're the ones who are going to implode. Because the only sign of "reflation" is the one they've fabricated in their Faux News addled Twinkie brains. Throwing their money away on junk cyclicals at the end of the cycle while telling themselves that the economy they outsourced is floating back from China.

It only took eight years, but they finally bought the "reflationary" fantasy hook, line, and sinker. In a world with excess everything, the sheer idea that there could be sustained inflation in absence of a well-paid "consumer" is asinine. It's a testament to how oblivious econoDunces are to the global poverty disaster they themselves have created.

And today's OPEC meeting very likely signals "Peak Oil", but of course in the exact opposite way that gamblers expect - Very likely the highest oil prices that will be seen for a long, long, time...

But first, following the Trump shocker, global investors wholesale abandoned the bond market. Meaning that global monetary tightening is underway:

Donny just monkey hammered bonds for their worst month EVER:

"Calling an end to the three-decade bond bull market is no longer looking like a fool’s errand"

There's only one problem. EVERYTHING gets priced off of Treasuries, and it's shocking that casino gamblers chasing Dry Ships and other parabolic junk don't know that fact.

Meaning that Treasuries can't implode without taking everything else down with them. Far more likely yields back up until everything implodes and then Treasury bonds rally in RISK OFF mode.

Let's take a look:

Start with the obvious, we've seen this movie before...

One year Treasury with Fed funds rate:

USDJPY having the same rally as 2008 alongside small banks:

Russell / Dow (Small cap rally) overlapped with small banks as well:

IPOs with Brokers:

Consumer staples

Utilities

Retail

Defense/Military

Big Pharma

Rest of the World:

Breadth:

And what about Peak Oil Prices?

This looks right now, doesn't it?

WTI (black) withe Energy Stock overthrow (red):

The globalized economy is a colossal Ponzi Scheme in which the vast majority survive on the bread crumbs falling off the table. The possibility of 7 billion people achieving a consumption-oriented lifestyle is zero, so the World Bank conveniently set the poverty line at $1.25/day to legalize global slavery. As long as someone else's children are doing the suffering, it's "all good". Post-2008, this illusion was extended merely by plundering all future generations.

Wednesday, November 30, 2016

WARNING: False Profit

The Forrest Trump Corruption rally is going into manic blow-off mode...

Fannie Mae is spiking today, because Trump's new Goldman Sachs installed Treasury Secretary, says that the company which was bailed out by the last Goldman Sachs Secretary, Hank Paulson, is ready to be released back to hedge funds at taxpayer expense...

Needless to say, Goldman Sachs is very pleased with his nomination...

Unfortunately, Generation Corruption will get buried by their own greed, because by my own humble calculation, this shit show is ending...

OPEC finally cut a deal to reduce production by 1.2 million barrels per day. This is what that looks like on a global basis...

Assuming zero cheating, production would still be above where it was when they started six months ago at Doha...

Oil is in blow-off burial mode on 4x average volume, as Cushing sees the biggest total inventory build in two years...

i.e. smart money is liquidating into dumb money volume:

The rest of the Trump corruption portfolio is also in blow-off mode: Coal, Financials, Military/Defense, Industrials, and

High Beta:

However...

Treasury bonds and yield are getting monkey hammered

The Nasdaq is not happy

Big Cap Tech

Internet

The dollar blow-off is same as last year...

Utilities are done

Consumer staples are done

Municipal bonds just gave back two years of gains

Biotech has left the party

Real estate not happy

Today's goal was to fill the last open gap above, from Monday's open:

The TRIN (buying intensity) is where it was at the last two rollovers...

Fannie Mae is spiking today, because Trump's new Goldman Sachs installed Treasury Secretary, says that the company which was bailed out by the last Goldman Sachs Secretary, Hank Paulson, is ready to be released back to hedge funds at taxpayer expense...

Needless to say, Goldman Sachs is very pleased with his nomination...

Unfortunately, Generation Corruption will get buried by their own greed, because by my own humble calculation, this shit show is ending...

OPEC finally cut a deal to reduce production by 1.2 million barrels per day. This is what that looks like on a global basis...

Assuming zero cheating, production would still be above where it was when they started six months ago at Doha...

Oil is in blow-off burial mode on 4x average volume, as Cushing sees the biggest total inventory build in two years...

i.e. smart money is liquidating into dumb money volume:

The rest of the Trump corruption portfolio is also in blow-off mode: Coal, Financials, Military/Defense, Industrials, and

High Beta:

However...

Treasury bonds and yield are getting monkey hammered

The Nasdaq is not happy

Big Cap Tech

Internet

The dollar blow-off is same as last year...

Utilities are done

Consumer staples are done

Municipal bonds just gave back two years of gains

Biotech has left the party

Real estate not happy

Today's goal was to fill the last open gap above, from Monday's open:

The TRIN (buying intensity) is where it was at the last two rollovers...

Occupy Mass Corruption

A corrupt society can't recognize corruption...

Exactly one decade later, Mainstreet finally digs out from Wall Street's last party at taxpayer expense...

Not really...

Adjusted for inflation:

A society that never learns from its mistakes is begging to get buried by them...

ZH: Nov. 30, 2016

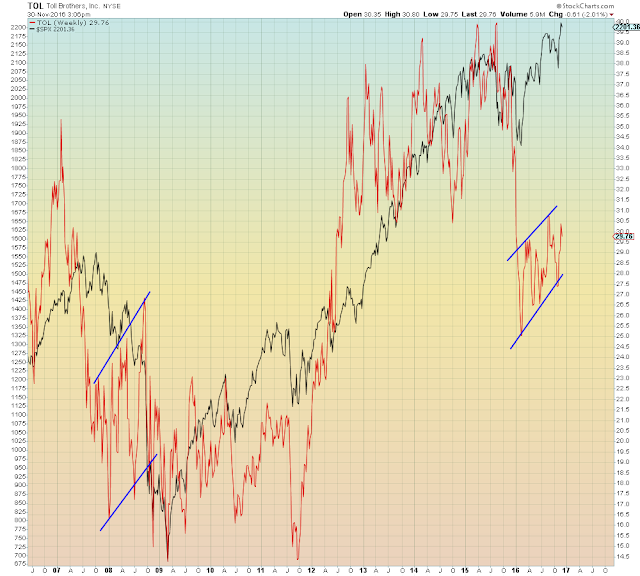

Mortgage Refinancings Collapse Amid Rate Rise

"Which does not bode well for homebuilders..."

Canadians had a chance to learn from the U.S. housing bubble, but decided to have one of their own instead. Real Estate Owned (REO) Politicians selling passports to fleeing Chinese criminals, in exchange for mass homelessness were all for it...

Guess how this ends...

Canadian house price index with Canadian GDP ($USD):

Exactly one decade later, Mainstreet finally digs out from Wall Street's last party at taxpayer expense...

Not really...

Adjusted for inflation:

A society that never learns from its mistakes is begging to get buried by them...

ZH: Nov. 30, 2016

Mortgage Refinancings Collapse Amid Rate Rise

"Which does not bode well for homebuilders..."

Canadians had a chance to learn from the U.S. housing bubble, but decided to have one of their own instead. Real Estate Owned (REO) Politicians selling passports to fleeing Chinese criminals, in exchange for mass homelessness were all for it...

Guess how this ends...

Canadian house price index with Canadian GDP ($USD):

Tuesday, November 29, 2016

The Fox Is In The Henhouse. Circa Cuban Revolution

CNBC Nov. 29, 2016

Trump Expected To Name Billionaire Wilbur Ross To Commerce Secretary

CNBC Nov. 29, 2016

The Forrest Trump Portfolio Is A 1950s Cyclical Investor's Wet Dream

Trump is this cycle's reflationary false dawn. He just pushed gamblers into a bunch of dead-end cyclical junk at the end of the cycle.

Russell / Dow ratio with small banks (black):

But don't take my word for it:

Westmoreland Coal

Fannie Mae

Freeport McMoran

Bristol Myers

Bank of America

Suncor Energy

Lockheed Martin

"Run Forrest, Run"

Generation Garbage just sold their soul to the orange devil, who promised them eternal wealth at the mere expense of the planet and their children's future.

"In the broadening (megaphone) top formation five minor reversals are followed by a substantial decline...smart money is out of the market in such formation and the market is out of control."

"Happy days are here again. We're taking the elevator ride back to the 1950s..."

Subscribe to:

Posts (Atom)