Were not meant to survive.

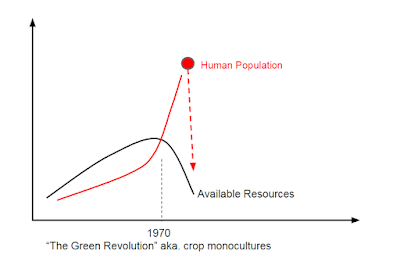

World's wildlife cut in half since 1970 (as human population doubled)

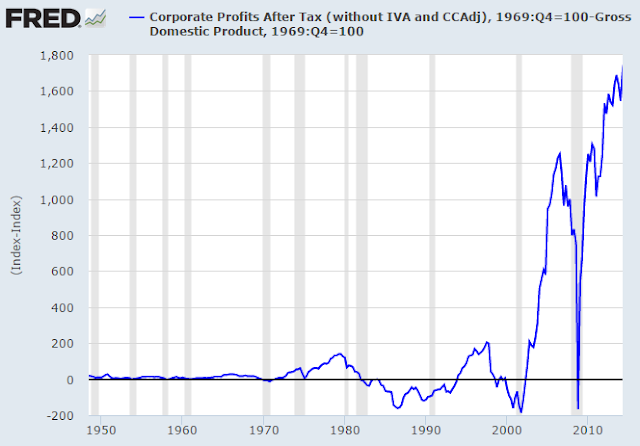

"Dude, where's the Conomy?"

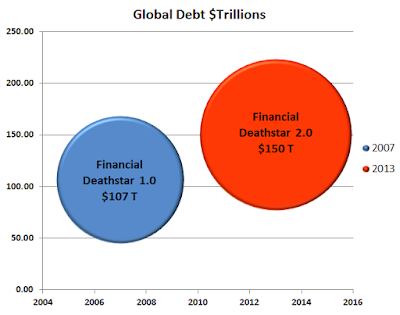

Deflation primed to accelerate lower, from multi-decade lows

Stocks versus the ever-deflating economy (via T-bond yields):

Darwin's law.

Something that fucking oblivious to its own well-being is not fit to propagate.

The Idiocracy is EOL.

World's wildlife cut in half since 1970 (as human population doubled)

"Dude, where's the Conomy?"

Deflation primed to accelerate lower, from multi-decade lows

Stocks versus the ever-deflating economy (via T-bond yields):

Darwin's law.

Something that fucking oblivious to its own well-being is not fit to propagate.

The Idiocracy is EOL.