The definition of a Ponzi scheme is insolvency disguised by liquidity. By total coincidence, Central Banks use liquidity to disguise insolvency. Bernie Madoff is wondering why he's the one in jail. The fact that Central Banks are willing to buy ever-more financial assets doesn't change their underlying value. Paying a trillion dollars for a brick doesn't make the brick worth a trillion dollars...

The Bank of Japan already owns over half of all ETF shares, and the the majority of Japanese Government Bonds. On Friday they announced an expansion of their ETF buying program. The Japanese Nikkei was up .5% on the news and the USDJPY tanked:

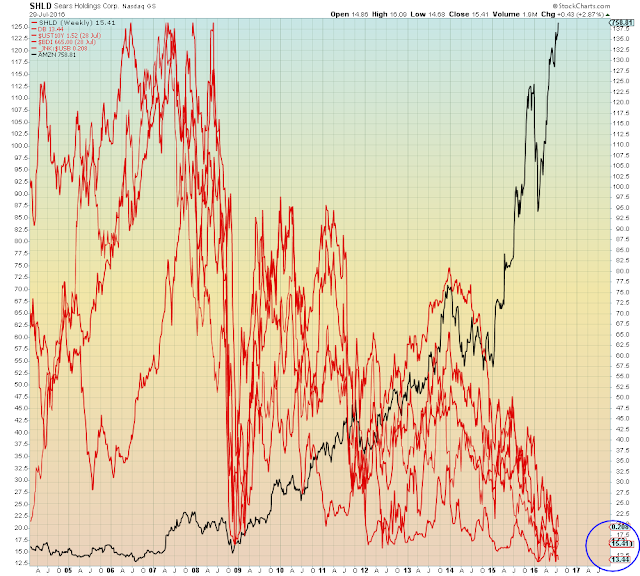

Japan and Europe with the combined Central Bank balance sheet (red).

Contrary to Idiocratic belief, what some fucking moron paid for a stock yesterday has no bearing on what it's worth today...

USDJPY

Not impressed...