A chorus of global Central Banksters who for eight years have encouraged and incentivized over-borrowing and asset speculation now ALL agree that it's time to finally raise interest rates from the historically low levels produced by the LAST crash. Why? Because it's time for the next crash...

Periodic economic resets are healthy for a variety of reasons - particularly to avoid excesses from accumulating to the point where the resulting crash creates a prolonged depression. But for another reason which is to ensure that the sociopaths who are inevitably in leadership are held accountable for the bad ideas they concoct over the course of the maturing cycle. Throughout the past 50 years, each recession has revealed scandals, ponzi schemes, and malfeasance resulting in jail time for the crooks involved. The late 1980s Savings and Loan crisis alone resulted in over 1,000 convictions. In Y2K, there was Enron, Global Crossing, Worldcom etc. Whereas the 2008 global financial crisis, which had orders of magnitude more impact than any past financial meltdown resulted in just one minor (U.S.) conviction (for some reason this article omits Madoff). Therefore, it should come as no surprise, that this cycle has led to the dumbest fucking ideas in human history now being deployed to unnaturally extend the cycle. At ALL costs. Meaning that first off, none of the sociopaths see this coming, and secondly the amount of underlying economic damage incurred in the meantime is unprecedented.

Just this week, we learned that amid record debt levels, the Central Banksters, falling prey to history's largest example of groupthink have all decided to tighten at the exact same time:

"Global debt levels have climbed $500 billion in the past year to a record $217 trillion, a new study shows, just as major central banks prepare to end years of super-cheap credit policies"

World markets were jarred this week by a chorus of central bankers warning about overpriced assets, excessive consumer borrowing and the need to begin the process of normalizing world interest rates from the extraordinarily low levels introduced to offset the fallout of the 2009 credit crash.

Years of cheap central bank cash has delivered a sugar rush to world equity markets, pushing them to successive record highs

One of the most authoritative trackers of global capital flows, the IIF report highlighted "rollover" risks, especially in emerging markets that have borrowed in hard currencies such as euros and dollars.

But the Bank of International Settlements (BIS) this week urged policymakers to disregard the potential market turbulence, including high debt levels, and press ahead with rate rises.

Cue, sociopathic bullshit:

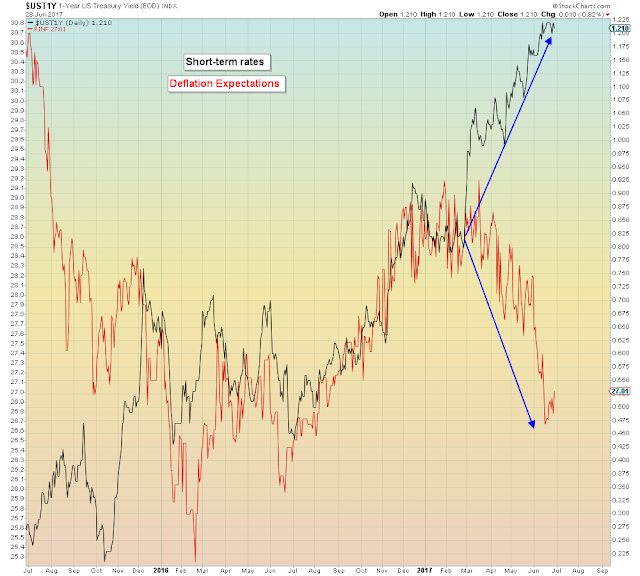

It’s all about yield-seeking capital flows, my friends. Tell us what interest rate is the tipping point which thwarts that behavior and we will tell you when the stock and credit markets top and flop

It's not about yield-seeking capital flows. It's about the marginal jobless consumer's ability to service their debts amid rising interest rates. In other words, you don't have to see a top coming, you just have to see morons being morons way too long and by the end believing they are getting away with it.

When in actual fact, there is no way out.

"A chorus of central bankers warning about overpriced assets, excessive consumer borrowing and the need to begin the process of normalizing world interest rates"

2 + 2 = Wave 5