In other words, this short-covering rally should be the last nail in the coffin for the reflation trade. And as we see, growth stocks are ready to implode at the same time:

Energy week is not to be confused with Infrastucture week which imploded infrastructure stocks three weeks ago...

Donald Trump will tout surging U.S. exports of oil and natural gas during a week of events aimed at highlighting the country’s growing energy dominance. The president also plans to emphasize that after decades of relying on foreign energy supplies, the U.S. is on the brink of becoming a net exporter of oil, gas, coal and other energy resources.

"Drill, drill, drill"

Indeed.

The entire commodity complex has been covering this week:

If you can't see this rally, you need a new microscope:

Healthcare week has been a bust for bulltards who expected Republicons to easily overturn Obamacare. Ironically it was defeated by the Genghis Khan wing of the party that wanted even more cuts to the program.

In other words the last sector making new highs, is not making new highs anymore...

No one with an attention span less than :15 minutes has seen this movie before...

Fracking burial 2.0

Coal Burial 2008 2.0

And retail is leading the market this week, so we know what that means:

Hard landing for dedicated muppets:

Today:

Banks 'very much stronger'; another financial crisis not likely 'in our lifetime'

Ms. Yellen is convinced that the actions taken by the Congress and the banking regulators have created a financial system in this country that can withstand significant stress without breaking. If one looks at the banking ratios, Ms. Yellen is making a good case.

However, if one assesses the impact of the new rules and regulations on this country, it is clear that the Fed has placed the United States at greater risk of a major collapse than at any time in the past 110 years – going back to the Panic of 1907.

The new regulatory environment demands that banks fail in the event of a crisis. It prevents any and all bank regulatory agencies from aiding a weakening bank. It is actually against the law for the government to bail out a bank now due to new regulations

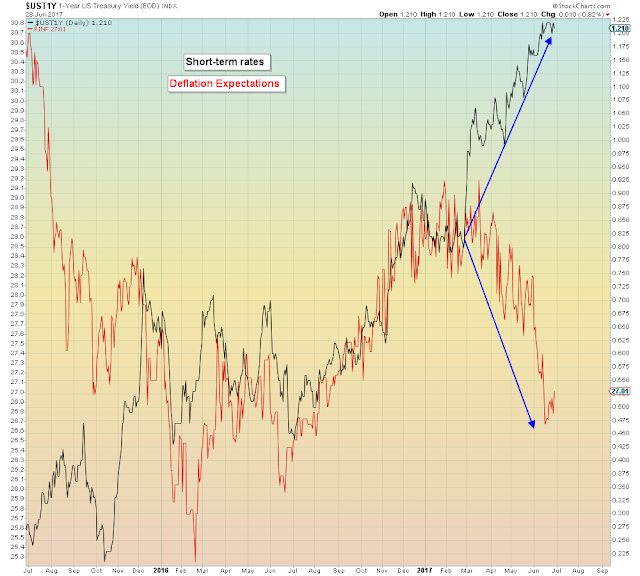

Just remember, deflation is "transitory", the Fed is raising rates to ensure that it remains so...