Speaking of plunder, there was a headline today indicating that magically in one week tax refunds are now at the same level as last year:

Looking at the IRS filing statistics, I was wondering how they pulled that off. It turns out that the first three weeks and ~23 million tax returns only had an average refund of $2640. However, the past week's average refund across 15 million returns was almost 50% higher ($3926). Now does that mean that everyone gets the average, no. Does that mean that the first 23 million people get an increased refund, no. What it means is that the Trump administration data mined 15 million people who will receive a tax refund almost 50% higher than the true average.

Because they assume that everyone is as dumb as they are and incapable of sixth grade math.

In summary, don't worry, be fat, dumb, and happy:

"...people really should be focused on the fact they’re paying lower taxes,” Mnuchin said. “Those lower taxes is money going back into the economy, and that’s why we have the economic growth we do.”

Lower taxes are going back into offshore bank accounts:

Where was I...

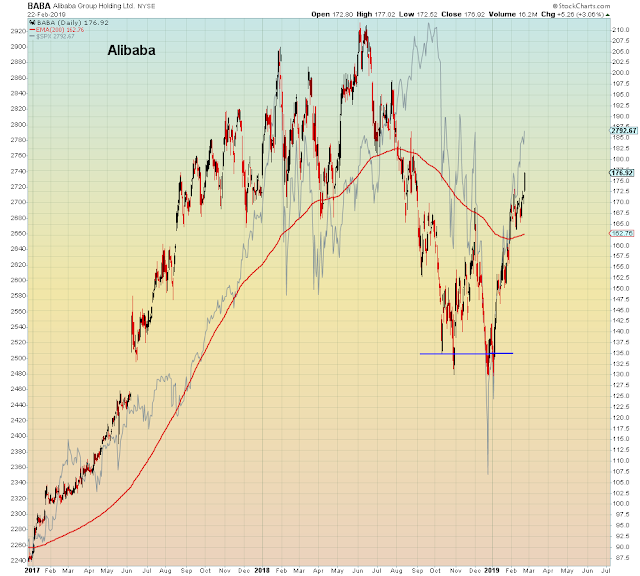

One year later and the trade war rages on, the casino somehow still bilked by every fake headline. The key sticking point is "technology transfer" which will never be resolved. Why? Because when factories are outsourced, the outsourcing country loses control over the manufacturing process, opening the door to reverse engineering. All of which would be obvious to a society that still valued scientific engineering over financial engineering.

The locus of implosion is complacency and denial. Imploding U.S. GDP obfuscated by record deficit. Global slowdown. Fed policy error. Misallocation of capital. Insider selling the highest since the 2007 top. Manic speculation in all forms of junk. And an abiding belief that recessions have been permanently eradicated.

Fortunately for denialists, the burden of truth remains on extinct bears, since drinking the Kool-Aid is the order of the day.

Where to begin.

Start with the impending volatility explosion off of the right shoulder:

Now discuss the "fundermentals" of borrowing 4% of GDP to have 2.6% GDP growth. What an honest man calls "recession".

"After the fourth-quarter report Thursday, Macroeconomic Advisors economists trimmed their first-quarter growth estimate by 0.1 point to 1.1 percent, citing an unexpectedly large year-end inventory build that implies a decline in inventory investment in the first quarter."

In other words, the fourth quarter was saved due to channel stuffing

WolfStreet:

Which confirms the 4th quarter retail sales implosion:

I predicted recently that the record stock buybacks was to allow corporate executives to flee the sinking ship.

Now we know that's what they're doing:

"Insiders who historically have shown the most insight sold more of their companies’ stock in the first half of February, relative to their buying, than they have in a decade"

Contrast insider executives with the general public who are the most bullish they've been since the left shoulder a year ago, and more bullish than they were at the all time high last September.

Yes, this again:

Meanwhile, crash protection plunged after September.

Which follows the 2008 pattern whereby hedge funds unhedged into the first decline.

Which was "too soon".

The Oil-Manager-in-Chief:

Despite a -40% drawdown, oil futures gamblers still haven't gotten the Trump memo.

They will get margined out when the next journalist is sacrificed on the altar of low oil prices.

Which gets us to imagined realities:

"Global index giant MSCI Inc. said it will announce on March 1 whether it will increase the weight of shares traded on the Chinese mainland in its global indexes from next year, a decision that could bring about 400 billion yuan ($59.9 billion) in inflows for the A-share market."

Home grown imagined realities

I know