That's what makes it an Idiocracy...

The 1970s "stagflation" was the wakeup call that developed nations could not compete head to head with the Third World. Overuse of fiscal and monetary stimulus were attempting to compensate for a lack of competitiveness. The Post-World War II Demand-side "Keynesian" world order was over. 1980, enter "Supply Side" economics. *Free* Trade, was the solution to everything. Lower taxes would pay for themselves we were told. Then a decade later, the Federal debt had tripled, at the fastest rate in U.S. history. Time to reassess. Hell no. Double down on *Free* trade and inject more monetary stimulus. Y2K Dotcom bubble and China WTO accession, time to reassess? Hell no, triple down on *Free* trade, and go to 1%. Housing bubble and bust. Time to reassess? Fuck no, 0% for seven years and stock buybacks in place of revenue.

EconoDunces think that making cappuccinos is as good as making semiconductors. AND they think that Central Banks set interest rates.

Sadly, neither of those assumptions is true. However only when they lose their jobs will they realize they were always just dunces...

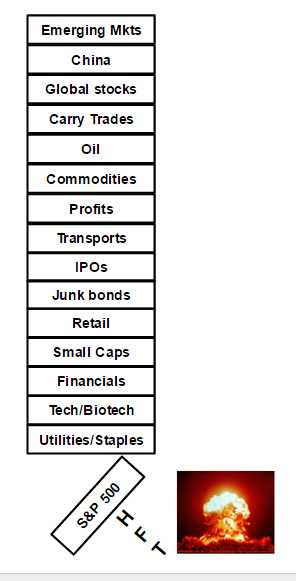

Going out of business visualized:

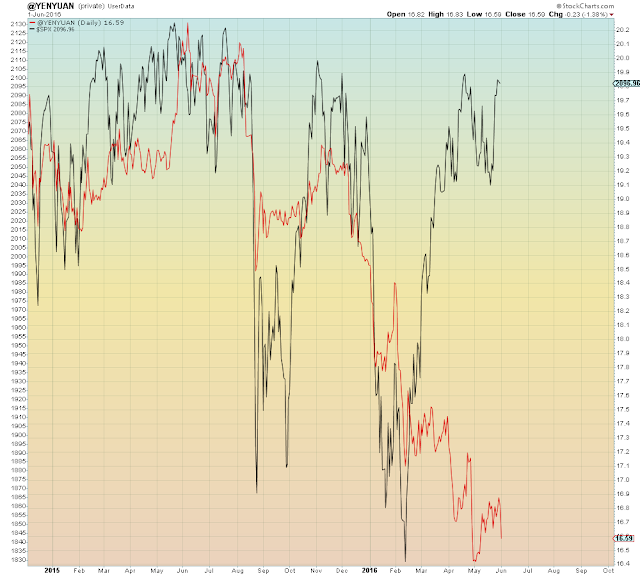

Fed Funds (interest rates) with capacity utilization (red):

The stock buyback "Achievers" Fund

This lesson will be tattooed on the Idiocracy. Stock buybacks do not compensate for collapsing revenue, they're the smoke and mirrors that allow insiders to cash out prior to collapse...

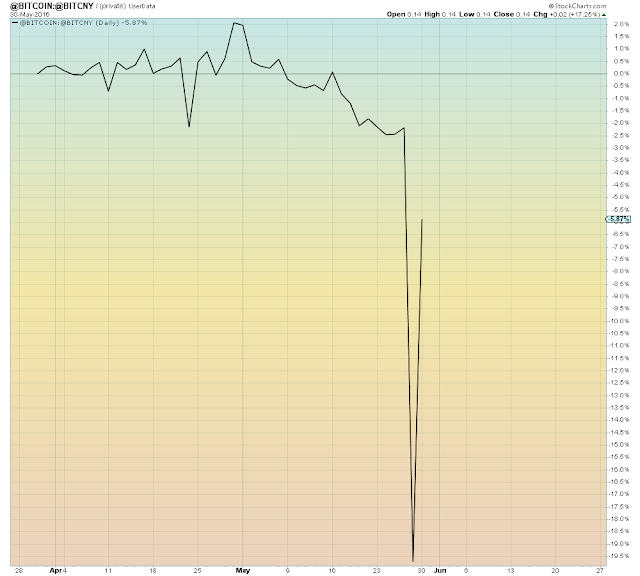

And -50% Flash Crashes are not "normal"

For the record, George HW Bush lost re-election in 1992 primarily because he tried to raise taxes. He was one of the only non-believers in PonziNomics in his party, although he lied about it. His son of course further lowered taxes for the ultra-wealthy, all paid for with debt, followed by a mega-crash and a doubling in debt. A mere harbinger of things to come...