"My sense is that markets are well-prepared for a possible rate increase globally, and that this is not too surprising given our liftoff from December and the policy of the committee which has been to try to normalise rates slowly and gradually over time,"

December? You mean the one that precedes January?

The Federal Open Mouth Committee continues to take EVERY opportunity to inform global markets that they're ready for a rate hike. Meanwhile, fully to the contrary, China reminds the Fed every day that they're not ready for a rate hike, by devaluing the currency. The rest of "RISK" idles on the sidelines on minimal volume. Something has to give.

Last night the CNY dropped yet again, now approaching the January lows...

Outflows remain hot and heavy...

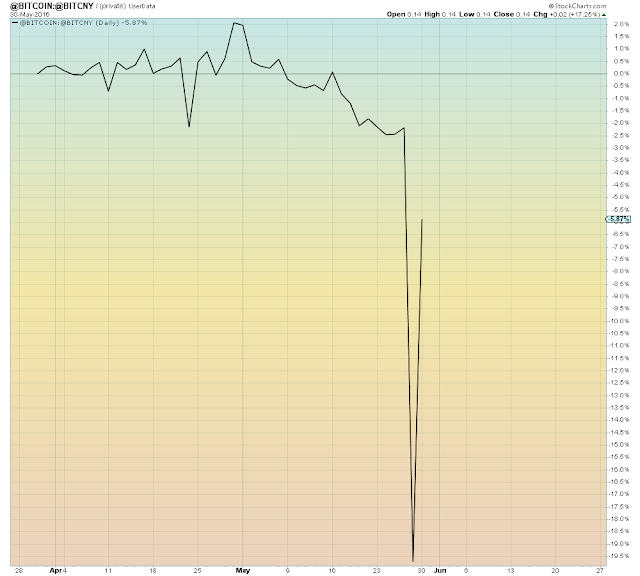

Meanwhile, the chasmic gap that opened up between BitcoinUSD and BitcoinCNY narrowed overnight, but still remains 5% wide. Someone who knows what they're doing could buy BitcoinUSD, exchange it for BitcoinCNY, and convert back to USD for an instant profit, 17,000% compound annualized. Assuming they were willing to own CNY for a few minutes...

Also this week (Thursday), OPEC meets in Vienna to inform 3x leveraged oil speculators that the freeze no longer exists and neither does OPEC. What could go wrong?

Lastly, on Friday is the May jobless report, which according to Zerohedge has the potential to "surprise" to the downside.

Meaning, yet another lie exposed.

All of which lies and chicanery can be summed up thusly:

This:

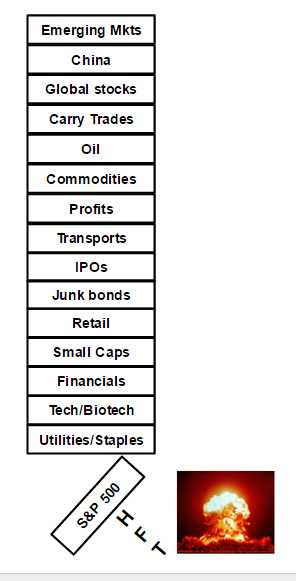

World ex-U.S.

And finally this:

U.S. Recession stocks:

Outflows remain hot and heavy...

Meanwhile, the chasmic gap that opened up between BitcoinUSD and BitcoinCNY narrowed overnight, but still remains 5% wide. Someone who knows what they're doing could buy BitcoinUSD, exchange it for BitcoinCNY, and convert back to USD for an instant profit, 17,000% compound annualized. Assuming they were willing to own CNY for a few minutes...

Also this week (Thursday), OPEC meets in Vienna to inform 3x leveraged oil speculators that the freeze no longer exists and neither does OPEC. What could go wrong?

Lastly, on Friday is the May jobless report, which according to Zerohedge has the potential to "surprise" to the downside.

Meaning, yet another lie exposed.

All of which lies and chicanery can be summed up thusly:

This:

World ex-U.S.

And finally this:

U.S. Recession stocks: