God gave mankind everything they needed, so they threw it in the landfill...

"For what shall it profit a man, if he gain the whole world, and suffer the loss of his soul?"

The soul is lost, and the world is next.

"...then mankind created God in his own image, to bless the depravity that was about to ensue. The first order of business was to create a holiday to celebrate conspicuous consumption and corporate profit"

Then when they least expected it, and were maximum leveraged to their consumption orgy, God took it all back, in her infinite wisdom.

They were shocked and outraged, that their corporate-granted right to consume had been revoked.

The Temple of Dow burned to zero. Plus or minus.

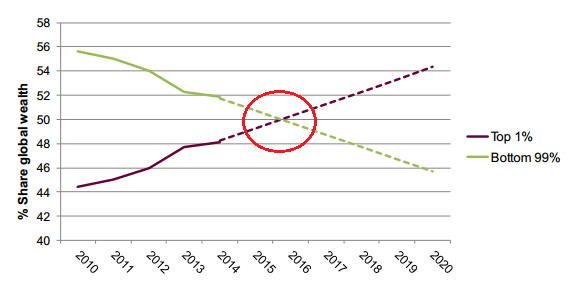

The globalized economy is a colossal Ponzi Scheme in which the vast majority survive on the bread crumbs falling off the table. The possibility of 7 billion people achieving a consumption-oriented lifestyle is zero, so the World Bank conveniently set the poverty line at $1.25/day to legalize global slavery. As long as someone else's children are doing the suffering, it's "all good". Post-2008, this illusion was extended merely by plundering all future generations.

Thursday, December 24, 2015

"At The End, They All Crowded Into the Same Four Stocks"

Any fund manager that didn't own Facebook, Amazon, Netflix and Google ["FANG"], underperformed the market, and hence was down on the year...

MW: Dec. 24, 2015

The Chart of the Year. Literally

“If you own the S&P 500, you were bailed out by a handful of giant companies that masked the pain beneath the surface,”

The S&P 500 is flat year over year. The % of NYSE stocks above their 200 day moving average has fallen from 55% to 32% over the course of the year:

FANG versus S&P:

Dollar Yen levitation. In full reversal.

The "Best Santa rally in four years", gets the market back to flat year over year...

FANG levitation. Check

Collapsed volume. Check

Santa Skynet is running out of tricks

MW: Dec. 24, 2015

The Chart of the Year. Literally

“If you own the S&P 500, you were bailed out by a handful of giant companies that masked the pain beneath the surface,”

The S&P 500 is flat year over year. The % of NYSE stocks above their 200 day moving average has fallen from 55% to 32% over the course of the year:

FANG versus S&P:

Dollar Yen levitation. In full reversal.

The "Best Santa rally in four years", gets the market back to flat year over year...

Overbought

NYSE Oscillator is at a 2.5 month high:

Nasdaq Count

FANG levitation. Check

Short-covering. Check

Volatility compression. CheckCollapsed volume. Check

Santa Skynet is running out of tricks

2015: Year of Imagined Realities

Rewind to one year ago...

ZH: Dec. 31, 2014

Hedge Fund Manager: I Am Taking The Blue Pills Now

"There are times when an investor has no choice but to behave as though he believes in things that don't necessarily exist. For us, that means being willing to be long risk assets in the full knowledge of two things: that those assets may have no qualitative support; and second, that this is all going to end painfully"

"Truth is what we should rid ourselves of as fast as possible and pass it on to somebody else,"

"To conclude I thought that I would expand upon our present Platonic thinking on the Chinese equity market. China is set to record its weakest growth in GDP in 25 years. Yet it seems to have entered a bull market and may be where we deploy much more of our risk capital next year. That's because the recent exuberant run up in onshore Chinese equities seems to me to amply demonstrate the power of imagined realities"

China with GDP growth rate:

The Rydex asset allocation (Bull : Bear):

UnHedging:

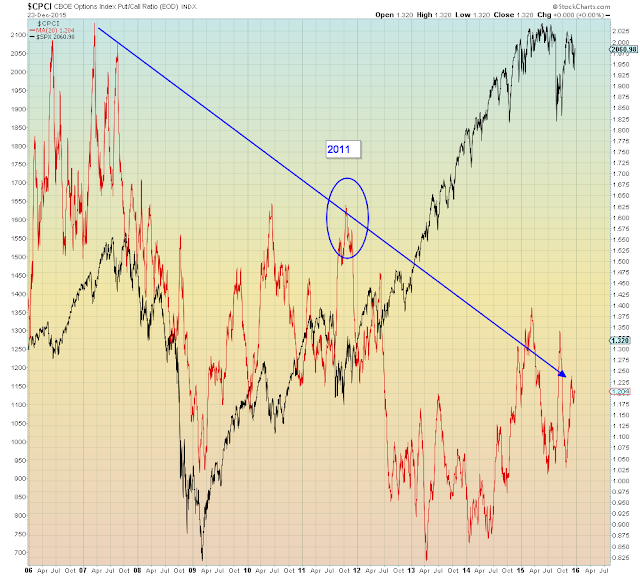

Index put/call

FULL Walmartization: Third World Aspirations

The fundamental flaw in modern PonziNomics, is that EconoDunces never measure who benefits. They just say "well there's more money, so that means the system's working great..."

And then they lose THEIR job and realize belatedly that they were always only dunces in the first place.

2016 is the year Oxfam predicts that the wealthiest 1% will have more money than everyone else combined...

MW: Dec. 24th, 2015

Great News: Jobless Claims Are the Lowest Since 1973

The key to Obama's pseudo-recovery, is that when unemployment insurance runs out (99 weeks), then people are no longer counted as officially unemployed.

You see, according to the Idiocracy, if you can't find a job after a certain amount of time, then you must be retired.

The U6 unemployment rate which is never published by lamestream jackasses, includes people who are long-term unemployed, plus people who have part-time jobs who used to have full time jobs.

As we see, Obama's "recovery" has left unemployment at levels previously associated with recession...

1973 was not a good year for lying, either...stocks went down in a straight line when the "Nifty 50" rolled over. Back then fund managers only had to own 50 stocks to beat the market. Today gamblers only have to hold the FANG 4 to beat the market...

"The de facto Idiocracy grew much smarter over time, eventually concentrating all of their fake wealth in just four must-own stocks"

Nasdaq 100 with Nasdaq % of stocks above 200 dma

And then they lose THEIR job and realize belatedly that they were always only dunces in the first place.

2016 is the year Oxfam predicts that the wealthiest 1% will have more money than everyone else combined...

MW: Dec. 24th, 2015

Great News: Jobless Claims Are the Lowest Since 1973

The key to Obama's pseudo-recovery, is that when unemployment insurance runs out (99 weeks), then people are no longer counted as officially unemployed.

You see, according to the Idiocracy, if you can't find a job after a certain amount of time, then you must be retired.

The U6 unemployment rate which is never published by lamestream jackasses, includes people who are long-term unemployed, plus people who have part-time jobs who used to have full time jobs.

As we see, Obama's "recovery" has left unemployment at levels previously associated with recession...

1973 was not a good year for lying, either...stocks went down in a straight line when the "Nifty 50" rolled over. Back then fund managers only had to own 50 stocks to beat the market. Today gamblers only have to hold the FANG 4 to beat the market...

"The de facto Idiocracy grew much smarter over time, eventually concentrating all of their fake wealth in just four must-own stocks"

Nasdaq 100 with Nasdaq % of stocks above 200 dma

Wednesday, December 23, 2015

The No Zen Zone: A Self-Inflicted Death Spiral

The corporate disposable batteries are fully drained and ready for disposal. The Idiocracy's biggest problem is itself

When a society has no values, then it values nothing, aside from its own conspicuous consumption...

When a society has no values, then it values nothing, aside from its own conspicuous consumption...

The signature of the Idiocracy is a society that can't get out of its own way. Every problem is self-inflicted. The higher concerns of humanity can never be addressed, because the Idiocracy is too busy setting itself on fire. Planning for the future is not an option when the refugee camp is in continual red alert mode. We have to invade country 'x', because the invasion of country 'y' didn't go as planned. "We can't fix ourselves, so we might as well fix the foreigners".

Looking at any one individual and you can see it on a micro scale. We live in a society of addicts, wherein entire industries aka. big pharma, are devoted just to saving people from themselves. The side effects are worse than the problem itself, and can be "easily remedied" with more pills...

Just this week we learned that "lifestyle" choices are responsible for 70-90% of cancers:

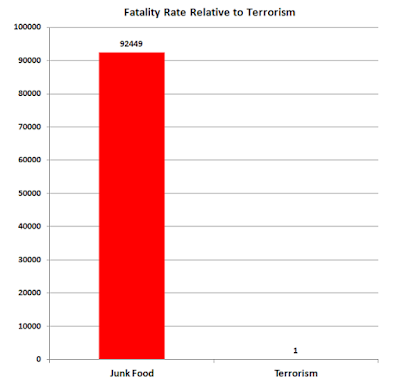

Today's corporate model consists of fostering addiction to ensure repeat customers. It's where the marketing dollars are spent and the so-called "R&D" on what type of crack junk food will most likely induce the primal instinct to over-consume.

Today's de facto "business model" consists of killing people as slowly as possible...

Over a billion confirmed kills

The Empire is under Big Mac Attack

(Combined fatality from heart disease, cancer, diabetes):

Over a billion confirmed kills

The Empire is under Big Mac Attack

(Combined fatality from heart disease, cancer, diabetes):

Tops Are A "Process". Followed By An "Event"

A three day short-covering rally on no volume. What could go wrong?

Shorts are the only thing keeping this market up, since 2015's leadership stocks "FANG" (Facebook, Amazon, Netflix, Google) are rolling over

Internet fund / Russell 2000:

Equal weight / cap weight:

Either Dollar / Yen rallies or this shit show ends post haste...

Wall Street believes in the fake recovery. Bonds, not so much

Dollar / Yen with Bond yields

Shorts are the only thing keeping this market up, since 2015's leadership stocks "FANG" (Facebook, Amazon, Netflix, Google) are rolling over

Internet fund / Russell 2000:

Equal weight / cap weight:

Either Dollar / Yen rallies or this shit show ends post haste...

Wall Street believes in the fake recovery. Bonds, not so much

Dollar / Yen with Bond yields

Buried By Greed and Stupidity aka. The Soylent Idiocracy

Denialists have no clue they're being bent over the log, with a big smile. Again...

"The profoundly cynical denialists had no clue it was ending, because they didn't trust anyone who could be trusted. They were too busy laughing about their last bilking, to realize it was happening all over again. The 2008 free-money bailout was their "insurance" against Wall Street's reckless gambling in the future..."

It was a new economy, to replace the old economy, which had been outsourced for special dividends...

The S&P just moved back to unchanged for the year. All it took was an entire year's worth of retirement money to get it back to break-even...

Realized volatility aka. binary risk

KA-CHING!!!

A year's worth of retirement money, straight into offshore bank accounts:

Price / volume

"Concern", meaning no action aka. The Idiocracy in a nutshell...

Up volume / total volume

"The usual tools went ALL IN at the top. Again"

Volume by price

Stock buybacks were used to cover up the collapsing profits and insider selling. Stoned zombies were bent over the log, enjoying every minute of it...

"The profoundly cynical denialists had no clue it was ending, because they didn't trust anyone who could be trusted. They were too busy laughing about their last bilking, to realize it was happening all over again. The 2008 free-money bailout was their "insurance" against Wall Street's reckless gambling in the future..."

It was a new economy, to replace the old economy, which had been outsourced for special dividends...

The S&P just moved back to unchanged for the year. All it took was an entire year's worth of retirement money to get it back to break-even...

Realized volatility aka. binary risk

KA-CHING!!!

A year's worth of retirement money, straight into offshore bank accounts:

Price / volume

"Concern", meaning no action aka. The Idiocracy in a nutshell...

Up volume / total volume

"The usual tools went ALL IN at the top. Again"

Volume by price

Stock buybacks were used to cover up the collapsing profits and insider selling. Stoned zombies were bent over the log, enjoying every minute of it...

Tuesday, December 22, 2015

"By The End, Faking It Was A Full Time Job And A Half..."

The reality that their consumption orgy was ending was beyond their fragile mental capacity to accept, so true to form, they just pretended it wasn't happening...

"Party time: stocks advanced for a record two days straight and are now back in November 2014:"

Cascading sell-off aka. nested 1s and 2s...

Counting nested 1s and 2s off the top in May, using internals to give a clearer view of the nested fractals...

Except this time the market is far weaker, and this is wave 3 at all degrees of trend...

% of S&P stocks above 200 dma

"It was a long way down to their fake-believe economy. aka. Pavement..."

Treasury bonds were already way ahead of stocks...

20 Year versus One year Treasury yield...

But stocks caught down quickly...

Because: "No One Can Predict The Inevitable"

2015: The Big Short. Squeeze.

Skynet is squeezing shorts (again), ahead of collapse

ZH: Dec. 22, 2105

Smart Money Options Indicator Is Record Bearish

Momentum...

Skynet is squeezing shorts (again), ahead of collapse

ZH: Dec. 22, 2105

Smart Money Options Indicator Is Record Bearish

Momentum...

Monday, December 21, 2015

'Tis The Season For Full Bankruptcy...In Jesus' Name. Amen.

The fate of the consumption zombies and the self-bankrupting corporations are bound together. One and the same...

It's sadly fitting that a religious holiday intended to celebrate generosity and altruism towards others was hijacked by corporations to instead become an excuse for the year's largest consumption binge. Like everything else in the Idiocracy, the holiday now represents the exact opposite of what was intended...

"We only had forty years' notice"

The collapse of Globalization will be a once in human history event. No one can put humpty dumpty together again. Therefore, I am constantly amazed by people talking about the various proximate and secondary causes of this fiasco, while assiduously ignoring the fundamental root cause of it all. There will be no do over. The Titanic will not be raised from the bottom and placed back into service.

The consumption oriented lifestyle was put on notice decades ago. Only asinine levels of debt accumulation and Third World enslavement has allowed it to last this long. Since 1970, the human population has doubled while the wildlife population was cut in half. Commodity resources have been depleted on a similar scale. Therefore the ratio of humans to resources, grew by a factor of 400%, at an ever-more exponential rate. Parabolic.

Red alert: China's $.80/hr minimum wage can't compete with the other Asian sweatshops, so they are now debasing their currency on a daily basis.

Environmental degradation, human trafficking, mass poverty, lethal pollution, ghost cities, jobless consumers, low prices at Walmart, all ending with mass bankruptcy. Proof for today's Idiocracy that "Globalization is working..."

This entire Ponzi scheme is running into the brick wall of Third Grade math. No surprise, today's degenerate country club is desperately casting about for proximate scapegoats - blaming the symptoms while assiduously ignoring the root cause...Corporations import deflation (poverty) and Central Banks turn it into 0% for self-bankruptcy. Lockheed Martin "Keynesians" paper over chasmic trade deficits with ever-more debt. All of which is second derivative.

It's the insolvent consumption zombies who are going away, and they will take the insolvent corporations with them. Those who don't believe it, are along for the ride...

It's sadly fitting that a religious holiday intended to celebrate generosity and altruism towards others was hijacked by corporations to instead become an excuse for the year's largest consumption binge. Like everything else in the Idiocracy, the holiday now represents the exact opposite of what was intended...

"We only had forty years' notice"

The collapse of Globalization will be a once in human history event. No one can put humpty dumpty together again. Therefore, I am constantly amazed by people talking about the various proximate and secondary causes of this fiasco, while assiduously ignoring the fundamental root cause of it all. There will be no do over. The Titanic will not be raised from the bottom and placed back into service.

The consumption oriented lifestyle was put on notice decades ago. Only asinine levels of debt accumulation and Third World enslavement has allowed it to last this long. Since 1970, the human population has doubled while the wildlife population was cut in half. Commodity resources have been depleted on a similar scale. Therefore the ratio of humans to resources, grew by a factor of 400%, at an ever-more exponential rate. Parabolic.

Red alert: China's $.80/hr minimum wage can't compete with the other Asian sweatshops, so they are now debasing their currency on a daily basis.

Environmental degradation, human trafficking, mass poverty, lethal pollution, ghost cities, jobless consumers, low prices at Walmart, all ending with mass bankruptcy. Proof for today's Idiocracy that "Globalization is working..."

This entire Ponzi scheme is running into the brick wall of Third Grade math. No surprise, today's degenerate country club is desperately casting about for proximate scapegoats - blaming the symptoms while assiduously ignoring the root cause...Corporations import deflation (poverty) and Central Banks turn it into 0% for self-bankruptcy. Lockheed Martin "Keynesians" paper over chasmic trade deficits with ever-more debt. All of which is second derivative.

It's the insolvent consumption zombies who are going away, and they will take the insolvent corporations with them. Those who don't believe it, are along for the ride...

Subscribe to:

Posts (Atom)