Which is why every piece of information must be cast as good news:

Recall that last January, was the best start to a year since 1987. Nevermind how that irrational exuberance imploded, because now THIS is the new best meltup since 1987. Which of course just gets the casino right back to where last year's January rally started.

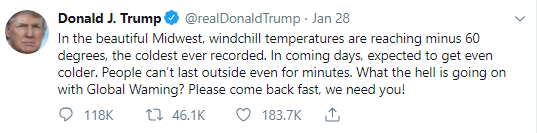

You can't make this shit up:

Unfortunately, if a 1987-style cascading waterfall crash were taking place in real-time, as it is now, there is no way the sheeple would know, because of the lamestream headlines.

Today's manic headlines give ZERO context for what has already transpired leading up to the current moment. They're a snapshot. In the context of a slap happy Idiocracy, they're at best a form of infotainment. At worst, they are highly misleading.

The Financial Services cartel wants us to constantly believe it's all good news as far as the eye can see. Why? Because this is a Ponzi scheme after all.

Here is where it gets interesting. Amazon, having cleared out the competition with predatory pricing, like all monopolists - has now decided to turn a profit. Which means it is morphing from growth stock to grown-up stock. The only problem is it is therefore having to sacrifice the top line to bolster the bottom line.

Wall Street is not happy that the stock is no longer in Peter Pan mode:

"Amazon reported an earnings beat across the board, but first-quarter revenue guidance fell short of expectations."

We've seen this movie before, just last quarter. We also saw a version of it exactly one year ago:

Speaking of waterfall crash, Amazon (above) is eerily similar to the Momentum portfolio shown below. Because it IS the momentum portfolio - and the most widely owned stock by hedge funds.

While above are the largest cap momentum stocks, small and mid-cap growth stocks are just getting back to last February's LOWS:

Unfortunately, China's Ecommerce behemoth, Alibaba, is saying the exact same thing as Amazon - growth is slowing.

Note the Idiocratic headline - they "beat" due to ever-lower expectations.

Which is why current trade talks are a zero sum game. And continually going nowhere.

The next meeting is slated for the end of February to coincide with Trump's next meeting with his other buddy, Kim Jong Un. Which will leave zero margin of error:

Sadly, this farce is running out of time, amid more fake news headlines:

"The upbeat mood was chilled somewhat by the White House insistence that March 1 was a hard deadline for a deal, a failure of which would lead to an increase in U.S. tariffs on Chinese goods...Analysts mostly remain deeply skeptical that a genuine trade deal can be done on this time frame”

"Asian shares are the highest since the last time the S&P 500 imploded"

"Fuckin-A, bubba"

The past decade visualized: