2020 contender Amy Klobuchar was taken aback this week when asked how often she attends religious service. How anyone thinks they will ever be president without answering that question five times a day is beyond me. Had she only answered, I attend voodoo seance five times a week, she would would have been just fine. It's when you tell them that you don't believe in anything other than God-given reality, that all hell breaks loose in Disneyland.

Global central banks' recent stand-down from tightening has convinced gamblers that they no longer need to hedge. Unfortunately, markets crash much faster than they rise. And about a million times faster than a money printing bureaucrat can reverse policy. Contrary to obligatory delusion, Money Printing 4.0 won't come fast enough to save this Ponzi scheme from final margin call...

In a nutshell, Wall Street monetized their hedges last Fall.

Their new hedge is called imagined realities. After all, it's not their money.

"There are times when an investor has no choice but to behave as though he believes in things that don't necessarily exist. For us, that means being willing to be long risk assets in the full knowledge of two things: that those assets may have no qualitative support; and second, that this is all going to end painfully...The recent exuberant run up in onshore Chinese equities seems to me to amply demonstrate the power of imagined realities."

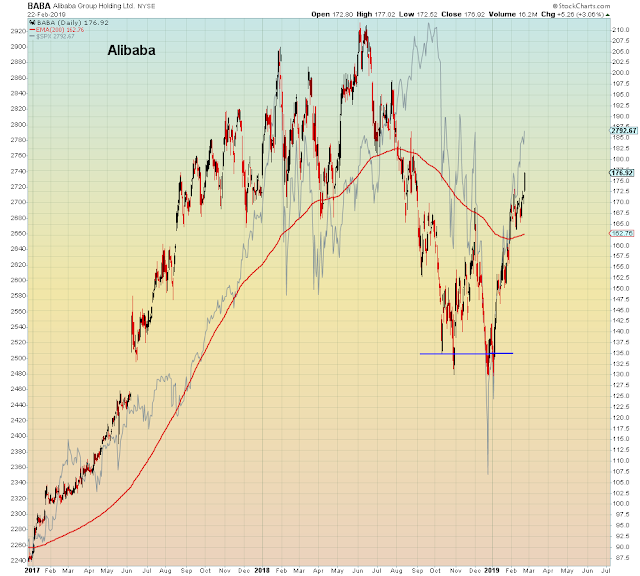

The December decline lasted 3 weeks, the rally back to the same level has lasted 9 weeks. Taken together, they comprise the 3 month trade war cease fire which expires March 1st. It should be abundantly clear from price action alone that markets EXPECT the trade war to be resolved soon:

More "good news", recession stocks are still leading.

Utilities just eclipsed their record high set in December.

No other U.S. sector is at record highs right now.

The other imagined reality is Big Cap Tech:

"Facebook was the most-owned stock by the largest hedge funds as the market staged its first-quarter comeback, followed by Microsoft, Alphabet, Amazon and Alibaba, according to Citi".

Facebook is dead money.

"The final report issued Monday by the U.K.’s Digital, Culture, Media and Sport committee concluded an 18-month investigation into Facebook and other social media companies for their role in spreading “fake news” and disinformation."

The path of humiliation has been chosen.

The story of the week that got magically contorted from bad news into good news came via the Fed minutes on Wednesday.

In a nutshell, they finally admitted they've been pounding risk markets, and they are resolved to do something about it in the second half of the year.

The minutes showed extensive discussion of market conditions, particularly on the emphasis that Fed actions were having on prices of risky assets like stocks and corporate bonds."

"Wall Street now expects the Fed to allow about $500 billion more of securities to roll off before the balance sheet reduction is halted."

$500 billion is more than what rolled off in all of 2018.

In summary, the b.s. cycle is ending, just not fast enough to save gamblers...

In this war, the only winner will be fake news and bullshit