Life in the Matrix has taught the Idiocracy two things about "investing" in Ponzi schemes:

1) "The good news is that mankind clearly has the ability to suspend rational judgment long and often"

2) Crashes are good because they mean more dopium.

What they still haven't learned despite multiple lessons, is that the cure for higher interest rates, is higher interest rates:

Hedge fund manager, Hugh Hendry, on life in the Matrix circa 2015:

"There are times when an investor has no choice but to behave as though he believes in things that don't necessarily exist. For us, that means being willing to be long risk assets in the full knowledge of two things: that those assets may have no qualitative support; and second, that this is all going to end painfully. The good news is that mankind clearly has the ability to suspend rational judgment long and often...China is set to record its weakest growth in GDP in 25 years. Yet it seems to have entered a bull market and may be where we deploy much more of our risk capital next year. That's because the recent exuberant run up in onshore Chinese equities seems to me to amply demonstrate the power of imagined realities."

Fast forward to imagined realities 2018:

"Earlier this year, fears about a sudden spike in inflation and an earlier-than-anticipated withdrawal of monetary stimulus caused yields on sovereign bonds to rise sharply"

The new bogeyman appears to be a slowdown in global growth

the euro-zone economy – the international success story of 2017 – has slowed to its weakest level since January last year

Other signs of slowing global growth have emerged in Japan where manufacturing output has lost momentum. In China, whose economy is expected to slow this year as a result of Beijing’s crackdown on debt, the manufacturing PMI for February suffered its sharpest drop in six years.

If the deceleration in global growth gathers pace – divergences in monetary policy will persist...Fears over an earlier-than-expected end to the quantitative easing programmes in Europe and Japan, which continue to buoy investors’ appetite for so-called “risk assets”, now look overdone."

"Everybody to the other side of the boat"

"Don't worry, when we crash again we get more dopium. Assuming no one gets margined out in the meantime"

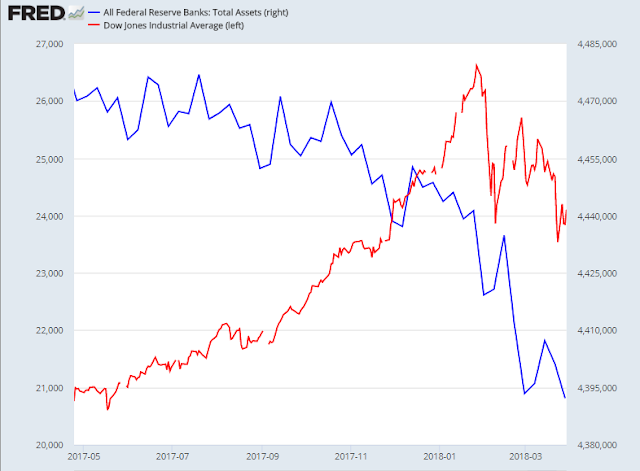

As I said yesterday, this is 2016 deja vu. Except for one minor detail, lower pane:

...the deflation trade has been pre-imploded by, what was it again...

The massively crowded fake reflation trade:

"fears about a sudden spike in inflation and an earlier-than-anticipated withdrawal of monetary stimulus caused yields on sovereign bonds to rise sharply"

"While there are plenty of reasons for investors to be nervous right now, fears about a surge in inflation and a sudden draining of the QE punch bowl are not among them"

Except in the country with the world's largest market cap

Fed balance sheet reduction started at $10 billion/month in Q4. Then it went up to $20 billion/month in Q1 which is when the wheels came off the bus. Now in Q2 it's set to increase to $30 billion/month.

Any questions?

Fed balance sheet (blue)

Dow (red)

"The aim of the Fed’s purchases over the past decade was to boost asset prices, and there could be a “symmetric reaction” once the assets roll off"

"Would I lie to you. Again? Oh ye of little suspended judgment"

I actually agree with two-face on this one, I just think that his timing is bad. But then again, so is mine...