Only a crash will stop the Fed from raising rates until there's a crash. All of the world's money is now riding on fake reflation...

Unfortunately, this doesn't go in reverse:

Unfortunately, this doesn't go in reverse:

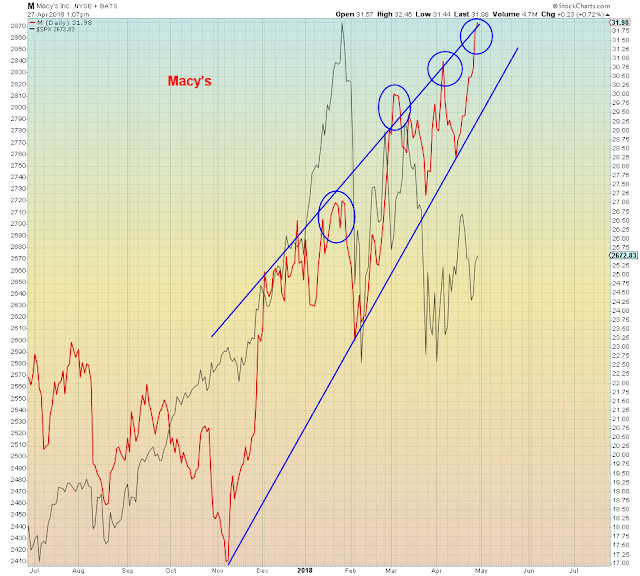

This was another week of the rinse cycle seemingly to nowhere. Two Central Bank meetings down (ECB/BOJ), one to go next week. As we see, the set-up is "identical" to March of this year:

Of course it's not really identical, it's only superficially identical. The continual deterioration at the hands of our trusted psychopaths has continued its relentless yet "imperceptible" downward trend.

"It's an old age home, so just keep lowering expectations"

"It's an old age home, so just keep lowering expectations"

"The U.S. economy slowed in the first quarter as consumer spending grew at its weakest pace in nearly five years, but the setback is likely temporary against the backdrop of a tightening labor market and large fiscal stimulus."

MW: Fastest Wage Growth Since 2008

Let's see, wages rising the fastest since Lehman and consumer spending lowest in five years. Third grade logic is beyond the grasp of today's Idiocracy.

And, the punchline:

ZH: Rate Hike Odds Just Increased

"While the long-term economic outlook is increasingly murky, today's data which saw a beat in GDP and the highest employment cost index since 2008, has convinced traders of one thing: a June rate hike is coming"

Fake reflation is following the same path as last year, and yet different...

In other words, banks have completed their end-of-cycle retracement, so now they can catch down to recession stocks:

This was the week that "good news" meant nothing, as extrapolation to infinity hit the brick wall of end-of-cycle:

"Trump administration’s business-friendly approach, a strong U.S. economy, robust manufacturing activity and improvements in the labor market augur well for the company"