This will be a record clusterfuck for the most corrupt generation in U.S. history. Facebook provided an example of what happens when a mega cap Tech stock loses its bid. Now picture all of mega cap Tech losing its bid at the same time. Think it can't happen? It has twice this year already, at this exact same point in the earnings cycle. As we see in the lower pane however, there was a tad more support previously:

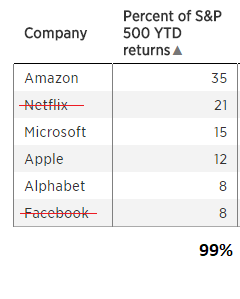

Tax cuts paid for with inter-generational plundering are being used to further enrich massively overpaid corporate insiders. Social Security deductions are stolen from paychecks and directed to the rich, while corrupt apologists say that Social Security is insolvent. Only in the U.S. would a deduction from your paycheck be called an "entitlement". The Republican party has morphed into the biggest organized crime syndicate in the history of the world. Suffice to say that none of them will be laughing when this all explodes with extreme dislocation, because this rampant corruption has led to record mega cap index concentration. And correlation:

"The practice appeared as though it might roll over as rising rates would make it difficult for corporations to continue borrowing in the debt markets to finance stock acquisitions...Then came the corporate tax cuts"

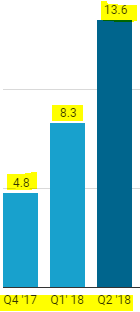

corporate share buybacks have dwarfed earlier records. In Q2 alone, corporations purchased a staggering $436.6 billion in stock buybacks"

corporate share buybacks have dwarfed earlier records. In Q2 alone, corporations purchased a staggering $436.6 billion in stock buybacks"

Here is where it gets interesting:

The article goes on to say that passive indexing is driving new funds towards the highest market cap stocks which are being sold at the fastest rate by insiders. Of course this is the middle of earnings season when stock buybacks are suspended, whereas insider selling is not suspended. Which is why volatility increases during the back half of earnings season.

Millions of shares sold:

The question on the table is, what happens when buybacks are suspended, amid record Tech sector concentration, earnings implosion, and record Fed liquidity withdrawal?

We're about to find out: