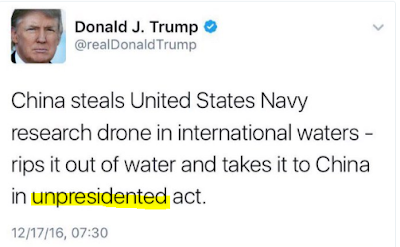

But first, a Freudian slip from the Nit-Twitter in Chief:

From the new President Hoover, back to the old President Hoover...

There's never actually been a crash from an all time high before. For example, 1929 (below), was from a failed lower high, and so was 1987 (not shown):

This past week I indicated that the number of highs and lows mid-week coinciding with the Dow's all time high were both surging at the same time. This is known as the "Hindenburg Omen". However, it gets worse...

The new Dow highs on Friday were exactly one, out of 30. The blue line is the 8 week moving average of new highs. Friday's one-day reading is circled. And the S&P / Dow ratio (red) is crashing in a divergence from the market, we've never seen before, and a rate of change (lower pane) only seen in October 2008:

In other words, most stocks are already in a bear market, and there are fewer and fewer, now one, large caps keeping this shit show elevated...

In addition, weekly money flow is heading down again, since this week featured strong opens and weak closes every day, the hallmark of what's known as a "bear market":

One week later...