The forces of global deflation had been accelerating long before Brexit, however, the historically massive devaluation of the British pound, monkey hammered global markets ex-S&P 500. Brexit was not just a repudiation of the EU, it was a de facto repudiation of the City of London, and Global Financialization...

The Idiocracy believes the exact opposite of the truth. The fantasy narrative of the past week is that "Global Coordinated Intervention" is underway. Unfortunately that is logically and physically impossible. Instead, the Globalized casino has pit Central Bank versus Central Bank in a zero sum game. If the S&P 500 is "winning", someone else has to be "losing"...

The biggest losers on the week were Global Financials, European stocks, China, and Japan...

The biggest losers on the week were Global Financials, European stocks, China, and Japan...

Since Brexit:

WTI Oil: -1.7%

European Stoxx 600: -4%

Japan Nikkei: -3.4%

U.S. Banks: -6%

Global Financials: -5.7%

Deutsche Bank: -22%

Credit Suisse: -21%

Barclay's Bank: -32%

Royal Bank of Scotland: -38%

Overnight risk

Nikkei

Nikkei

Overnight risk

European Stocks:

European Stocks:

Overnight risk

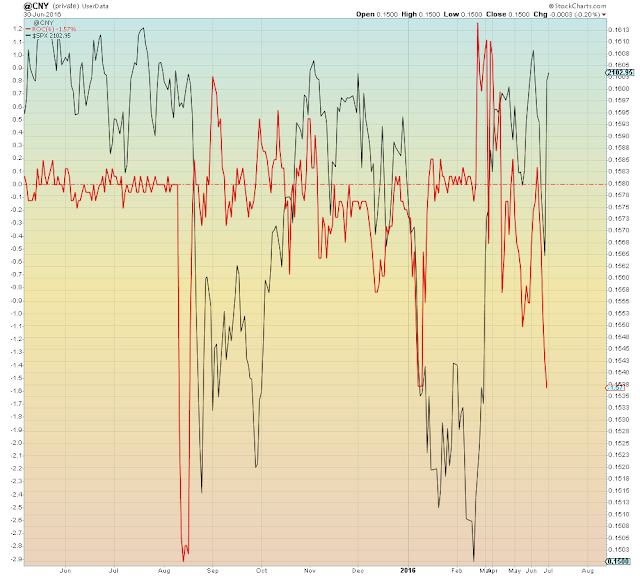

Chinese Yuan (6 day rate of change):

Chinese Yuan (6 day rate of change):

The BOJ was betting that the Fed would raise rates to strengthen the dollar. Now that that's never happening, their currency is fucked...

Contrary to the dunced narrative of the day, U.S. yields going lower is not "bullish" for stocks...

JPY and Treasury yields are now trading 1:1

Overnight risk

JPY

Overnight risk

World ex-U.S.

Contrary to the dunced narrative of the day, U.S. yields going lower is not "bullish" for stocks...

JPY and Treasury yields are now trading 1:1

Overnight risk

JPY

Overnight risk

World ex-U.S.

-3.7%