Corporate Investment Is Lowest In 60 Years

MonopolySoft, formerly the most profitable company in human history, featuring 90% gross margins, has laid off over 30,000 employees since 2009. All to fund the largest stock buyback in human history, $116 billion (over 10 years).

And yet, the company has lost $150 billion in market cap in the past 16 years due to share reduction, and lack of investment. In other words, it's all smoke and mirrors, to keep the stock price artificially inflated.

The Monopoly is wearing off. Gross margins have plummeted...

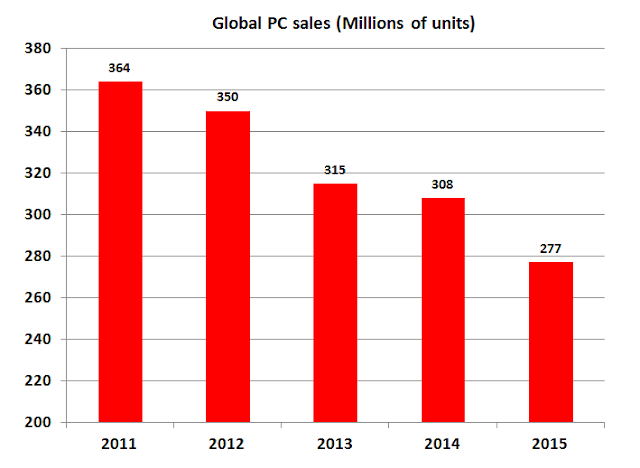

5 year view:

It's yet another example of a company putting itself out of business to make the quarter...

The Monopoly is wearing off. Gross margins have plummeted...

5 year view:

It's yet another example of a company putting itself out of business to make the quarter...

Meanwhile, the P/E ratio is 2x above its five year average...

Microsoft with Fed Balance sheet:

No company has bought back more shares in the past 5 years, than Apple. Which has reduced price and market cap...

Apple has lost $170 billion in market cap in the past one year, due to price and share count reduction...which is more than an entire IBM in market cap ($145 b)...

IBM is another perpetual buyback machine. This company has lost one third of its market cap since 2013:

Buyback "Achievers" Fund

Apple has lost $170 billion in market cap in the past one year, due to price and share count reduction...which is more than an entire IBM in market cap ($145 b)...

IBM is another perpetual buyback machine. This company has lost one third of its market cap since 2013:

Buyback "Achievers" Fund