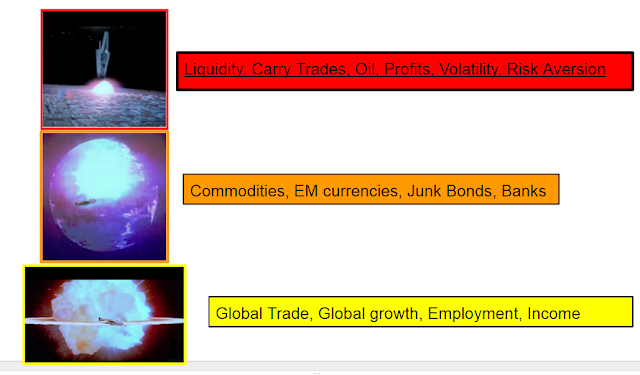

First order risk is (lack of) liquidity. Six weeks of low volume has masked risks. When volume picks up to the downside and gamblers realize they aren't getting out, this shit show will go into total fucking meltdown...

First derivative "trigger" risks have been rising steadily for over a year now, amidst non-stop fake-believe.

Second derivative risks have been accumulating for years

Third derivative risks were never resolved after 2008

S&P with volume

"Surprise motherfuckers, lying time is over..."

Price / volume