Nine out of ten people arrive at my blog by accident, either googling "BTFATH" or searching for Chinese internet stocks. The majority of those people shit their pants and head straight back to the Wall Street Journal.

The other ~five of you searched for "the world economy is a ponzi scheme" and landed here for a reason. I know, I see it in my blog's dashboard. One guy recently googled "fuck this globalized ponzi scheme"...AWESOME.

While we're waiting for this real-time clusterfuck to plough straight into the abyss with the utmost velocity, I thought it would be constructive to document the lessons learned. That way, when the anarchy and dust settle, we will have a head start on the future. Below I begin with some longer-term perspective on Ponzinomics...

A Brief History of Modern Deflation

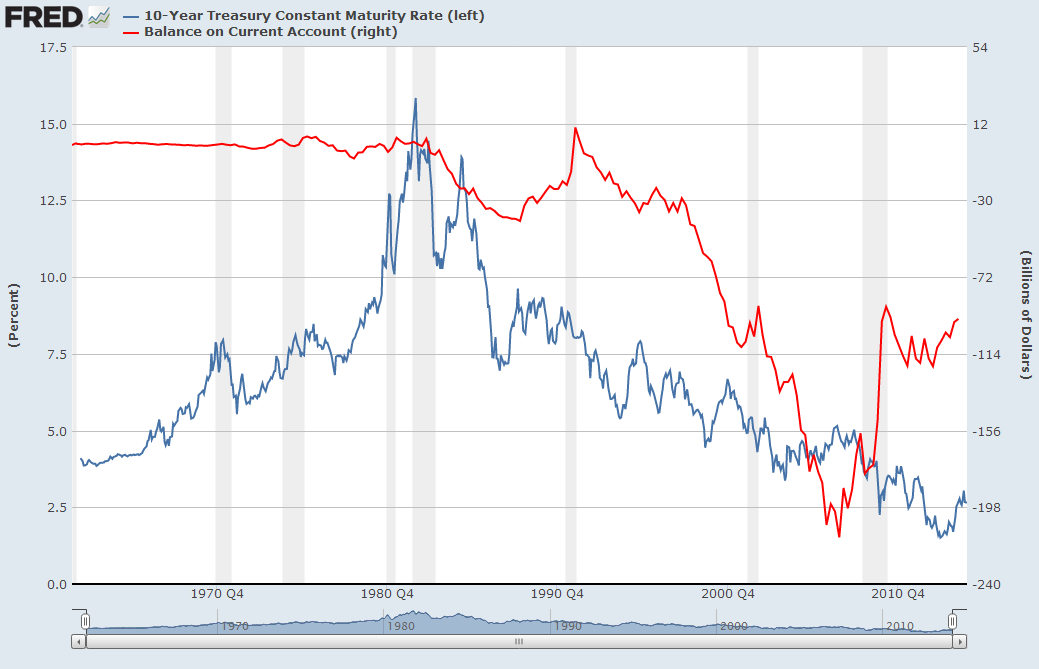

The U.S. went off of the "gold exchange" standard in stages between 1971 and 1973. As we see below, via the 10 year yield, "stagflation" (economic stagnation plus inflation) soon followed, peaking in 1980.

That period was a crucial juncture, because real median male wages peaked in 1973 signalling that the great post-WWII "peace dividend" had ended. A critical choice was faced - take the hard road and retool the economy for balanced trade. Or take the easy road and open the economy wide open to the Third World and thereby exchange the economy for debt.

We know which path was taken. Almost to the day that Reagan was elected, inflation peaked, as the balance of trade went negative.

The Idiocracy never questions where all of the "cheap money" comes from. It comes from selling the economy. The bond market has full faith and credit in the frat boys to continue outsourcing the economy.

U.S. Balance of Trade (red line)

10 Year Treasury Yields (aka. forward deflation expectations) (blue line)

Debt Went Parabolic

The Ratio of Total Debt to GDP was .7 in 1980, today it's 3.7

At the beginning of Reagan's term, the U.S. was the world's largest creditor (lender), eight years later, the U.S. was the world's largest borrower.

FULL THROTTLE END GAME

If you were flooring the accelerator in your car and it was only going 2 miles per hour, would you be worried? I would. That's where we are now with monetary policy. The throttle is wide open like never before and yet the economy is still barely above stall speed:

"Houston, We Have a Fucking Problem"

Fed Funds rate (blue), now at 0%, Fed Balance sheet (red), now at $4 trillion

Debt-adjusted, economic "growth" is still negative

HISTORY'S LONGEST VACATION FROM REALITY WITHOUT COMPARISON

At this very moment, today's policy makers are doing absolutely nothing to address the above issues, aside from ignoring them. Today's thought dealers have lived in the 34+ year vacation from reality for most of their lives, so they just inherently assume that the status quo is indefinitely sustainable. They never question how a country can consume four or five times its proportionate share of resources without any long-term economic consequences. Shopping mall sprees and consumption excess are taken for granted. The same is true for the stoned masses - they have no clue how quickly this can all end and how tenuously it's being (barely) sustained at this very moment.

PONZINOMICS: THE LESSONS LEARNED

Fundamentally, this entire era points to the catastrophic failure of modern economic theory for Monetarists, Keynesians (demand side), and of course the Supply Side.

1) Trading openly with nations that have no environmental or labour standard will lead to bankruptcy and/or a collapsed labour/environmental standard - likely both.

That's not Economics per se, that's commonsense, as brutally delivered via industrial arbitrage. Those Econ majors who don't understand arbitrage would do well to brush up on the topic or otherwise work in a real company for more than :15 minutes.

2) Using "Keynesian" fiscal stimulus on a long-term basis through recession and expansions and thereby allowing deficits to become baselined into GDP is a Supply Side "Voodoo Economic" disaster, now ending badly. Using fiscal stimulus to fund wars, military occupations and tax cuts for the ultra wealthy etc. is a predictable disaster. According to the "Laffer Curve", tax cuts pay for themselves via increased growth - 35 years later and that middle chart above shows just how large a delusion that is. Meanwhile, how the Supply Side Neocons hijacked Keynesian economics, will be a story for all time, especially how they co-opted Paul Krugman to put the stamp of phony approval on their chicanery throughout Bush's 3rd and 4th term, under the stewardship of Obama.

3) Relative to point #2, calling positive GDP growth an "expansion" when massive fiscal stimulus (borrowing) is the only thing maintaining that positive growth rate is nothing more than a widely accepted lie. For the past five years straight this economy would have been in full blown recession were it not for this society's compulsive willingness to bankrupt its grandchildren. A true recession doesn't end until fiscal and monetary policy are fully normalized and GDP growth is positive.

4) There is no free lunch, so this idea of setting up a Corporate arbitrage of sourcing in the Third World and selling in the First World, was always going to be a one time profit levitation trick that ultimately collapsed developed world economies. Every company somehow thought they were getting away with a risk free arbitrage by outsourcing their production, which of course in aggregate outsourced their end market aka. demand. Say's Law dictates Supply is Demand, meaning without supply there is no demand which is intuitively obvious in a barter economy. If the goal of billionaires was to collapse First World wages down to that of the Third World, it would have been far preferable to keep the jobs and industries in place and force everyone to take a pay cut. This idea of shipping the jobs, industries and intellectual property offshore until such time as it collapses, is a strategy reserved solely for the greediest and dumbest fucking society in history.

5) Manipulating the supply and hence cost of money to "grow" the economy, inevitably leads to 0% interest rates on the way to bankruptcy. Voila. Subsidizing debt by making it cheaper will merely encourage greater debt accumulation. That's Commonsense and Econ 101, something the PhDs apparently failed. One would have thought they could learn that lesson via the Housing Bubble, but apparently not.

Labour versus Kapital

In the short-term, (macro) economics is of course a trade-off between the return on labour and the return on capital. In the long-term of course, in a sustainable balanced economy, there needs to exist a sustainable return on labour and a decent return on capital in order to maintain supply and demand without debt accumulation. One company's costs are another company's revenues. Sadly, for an attention deficit society, the short-term is the only thing that ever matters, hence leading to EXTREME returns on capital at the expense of labour.

Austrian school economists would say that all of the above could be solved by a gold standard, which is true. Trade imbalances, prolonged fiscal deficits, monetary expansion are impossible when constrained by a gold standard.

In the Long-run Politics is Economics

However, the funny thing is, the U.S. was already on a gold standard but abandoned it in stages between 1934 and 1973, so fundamentally, the issue is trust and accountability. Political stooges at the behest of their moneyed special interest groups will always look for ways to subvert the system, even if it means taking the country off of "the system". Meanwhile, any system that exposes the majority of a populace to extreme degrading poverty, will ultimately be overturned. Violently. Regardless of how text book "efficient" it is deemed to be.

AND needless to say, this all by no means a uniquely American fiasco.

As of today, there is not one country in the entire world that is on a gold standard.