This is the first time in U.S. history that the stock market is peaking AFTER the beginning of recession...

Compliments of existential denial and unprecedented lying

"This is the longest cycle in U.S. history"

"Yeah, and it's only halfway"

Compliments of the unprecedented stimulus gimmicks employed during this era, the stock market is no longer a reliable barometer of the economy.

Hugh Hendry warned this would happen:

"The worse the reality of the economy becomes, the more we take on the reflexive belief in further and dramatic monetary expansion and the more attractive the stock market looks."

At this latent juncture, real-time GDP ("Now") is running at 1%. In other words, the U.S. is borrowing 4% of GDP to have less than 1% growth. A confirmed recession at any other time in U.S. history. When exceptional liars were not extant.

Couple MAXIMUM monetary and fiscal stimulus with existential lying, and it's no surprise the masses don't see it coming. Also no surprise, economists are as clueless as always. It took a FULL year (Dec. 2008) for the NBER to declare recession had begun the previous December, 2007. That was three months post Lehman. The Fed rate was already at 0% down from over 5%. Stocks were down -50%. If they didn't see that happening in real-time, they could never see this coming.

The other factor at play right now is this trade war, which has many people believing that once "the deal" is done, the economy will bounce back to full strength. That delusion is the one financial advisors are currently using against their own clients.

Then of course there is the passive indexing super bubble. This year for the first time, assets under passive management have exceeded assets under active management. Which is why valuations are at record levels.

If active managers were driving this market, the casino would have rolled over by now.

On top of all that are the record buybacks intended to keep the market bid up while insiders exit. Buybacks hit their all time high one year ago in the fourth quarter, and are now falling. In 2007, the peak in buybacks occurred a few months before recession began. As the article notes, ALL types of corporate cash spending is now falling.

Then there is the enduring myth of the invincible consumer. Record store closures this year have still not put that lie to rest. Amazon peaked one year ago. And the only consumer stocks making new highs, are all recession plays.

Compare Walmart:

To the rest of Retail:

Which brings up the point, why are "reflation" stocks currently leading this rally - banks, transports, homebuilders, retail, energy etc.. Right now, we are seeing a huge rotation out of deflation plays into economic cyclicals.

And the answer is due to EPIC short-covering.

We saw the same thing in 2008:

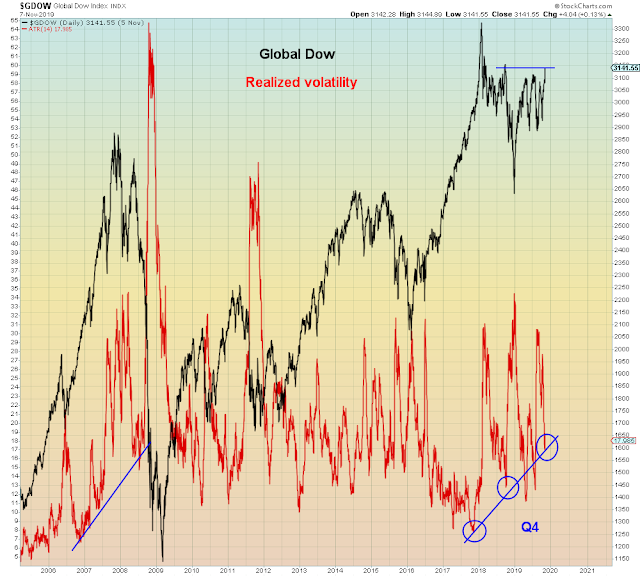

In summary, conflict of interest, existential lying, recessionary interest rates, a dumb money bubble, and RECORD combined fiscal and monetary stimulus.

Are driving this recessionary rally.