If there is a recession now, Herbert Hoover doesn't get re-elected. Which is why we are witnessing EPIC lying right now - high even by Banana Republican standards, as the echo chamber of exceptional fools works double-overtime dispensing lethal Kool-Aid to the true believers in criminality.

Be sure to get everyone.

Be sure to get everyone.

No wise man has the power to reason away

What seems to be

Is always better than nothing

Nothing at all"

We're at that point in the "cycle" where for "true believers", truth is no longer an option.

Choose one.

Economists have a good excuse for not seeing recession coming, because they never see recession coming. They have a perfect track record in failure to maintain. They use backwards-looking data models to "predict" the future, which is why they excel at predicting the past. A strategy that works great for most of the cycle and then fails catastrophically at the very end of the cycle...

Barron's this week:

The Fed has been complicit in EVERY recession in U.S. history, this one will be no exception. They are already .75% behind the (yield) curve:

Casino liquidity is non-existent. The exits to Trump Casino are already closed.

This prediction from July of this year was prescient:

“In our mind, this persistently low market depth leaves U.S. equities vulnerable from here if central banks fail to validate market expectations or U.S. recession risks resurface”

The S&P 500 has risen a stellar 19% this year, but the strong performance has been accompanied by light inflows and trading activity as well as low market liquidity, the analyst pointed out. The average market depth has been close to historical lows"

There are several reasons in this cycle why complacency is running much higher than normal at this point in the cycle, not the least of which is the incessant MAGA con job. Brainwashing on Twitter and elsewhere:

"...while working as an analyst, Kudlow wrote in December 2007 that there was no recession coming — just before the biggest recession the US has endured since the Great Depression struck.

“Well, I plead guilty to that late 2007 forecast“

In addition however, the chasmic U.S. deficit is now artificially propping up "GDP". The U.S. is currently borrowing 4.5% of GDP to generate 2% GDP growth. A recession at any other time in U.S. history i.e. when honesty prevailed. Inter-generational theft is now "GDP".

U.S. pundits have another bad habit of always using global collapse as a reason to ignore global economic collapse. The argument goes like this:

"As investors worry about a global economic slowdown and the threat of an ever-escalating trade war, they've been fleeing to higher-quality assets. These include long-term US government bonds."

"Wall Street experts point out that economic data in the US is looking pretty solid at the moment. They include Ed Yardeni of Yardeni Research"

"Inverted yield curves don't predict recessions...They've tended to predict financial crises, which morphed into economy-wide credit crunches and recessions."

I couldn't have said it better myself. Now put down the crack pipe son, you sound like a fucking moron

The other source of false optimism stems from the record stock buyback binge which has inflated earnings per share by reducing share count. This has concealed the earnings recession. Today's false pundits ALWAYS reference earnings per share, never aggregate earnings.

What we see in the chart below is aggregate corporate profit as share of GDP. What we notice is that corporate profit was fairly stable up until Y2K/9/11 Shock Doctrine took hold, and then it almost doubled. And rose again after the global financial crisis. Which is of course the mirror image of what happened to labor's share of GDP, which collapsed.

We also notice that aggregate profit growth relative to GDP peaked years ago and has been propped up subsequently by share buybacks. Absolute profit (not shown), peaked in 2012.

As we know, the Big Short protagonist, Michael Burry (and many others) have warned that the transition from active to passive management has fueled a valuation mega bubble.

Arguably this era's largest bubble.

Active managers have been far more reluctant to embrace this bubble:

And while on the subject of the Big Short, there is the unprecedented central bank driven push into risk which was also evident in 2008 at the onset of recession, which artificially narrowed risk spreads. Cue Christian Bale on the drums.

July 2019:

"The hunt for yield is making parts of the U.S. corporate bond market look a lot like 2007"

ZH: Hugh Hendry Explains Imagined Realities From A Money Manager's Annual Bonus Perspective

"He who hangs on to (economic) truth has lost...In the long run we will come to rue the central bank actions of today. But today there is no serious stimulus programme that our Disney markets will not consider to be successful. Markets can be no more long term than politics...the modern market is effectively Keynesian with an Austrian tail."

What does that mean? It means that it all ends with a massive "unforeseen" crash. As the unprecedented gap between fantasy and reality closes limit down.

All of which combined, is why gamblers just this week blithely ignored the worst start to a quarter since October 2008, instead buying the dip with both hands.

Thoroughly conditioned to welcome economic risk.

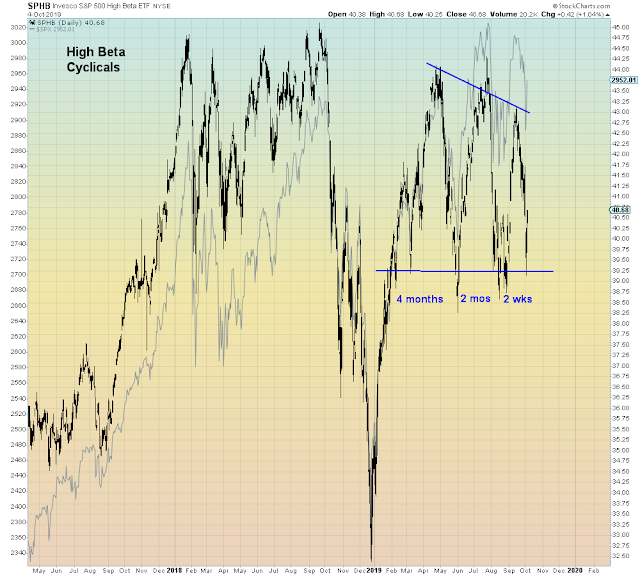

Which is where this gets interesting. Because this week was the third time that economic cyclicals have crashed down to support. Each rally of shorter duration. This last rally only lasted two weeks.

Small caps, same pattern - shorter- and shorter rallies

The other major issue from a technical perspective is the speculative Nasdaq, which is stalled at last year's level. It now sports a head and shoulders top.

Which in Elliott Wave parlance portends a third wave down.

Which leaves recession stocks - Staples, Utilities,

and Defense-, indicating an expansion of the volatility range:

Just remember,

No one was allowed to see it coming, because that could affect the quarter AND the election.