Central banks have done a great job of propping up fake billionaires and retirement gamblers for a decade straight, however, it appears they are out of ammo. Hard to believe, but it turns out that debt accumulation is short-term "reflationary" and long-term "deflationary" when the sugar high passes. The key lesson not learned in the past ten years as we borrowed our way out of a debt crisis.

As we see below, so far this latest money printing circle jerk is highly reminiscent of the last one:

Last week Draghi rolled out the bazooka, but markets were not overly impressed. In fact, the Euro gained on the news, while the dollar declined.

"Quantitative easing—the policy that dragged the world out of the Great Recession—is back, but it’s a shadow of its former self."

However, the package’s impact on financial markets was muted, coming across as half-hearted"

Without help from higher government spending, the ECB’s action is unlikely to achieve much"

Which turns the attention back to the Fed this week and the third fake reflation rally in a row:

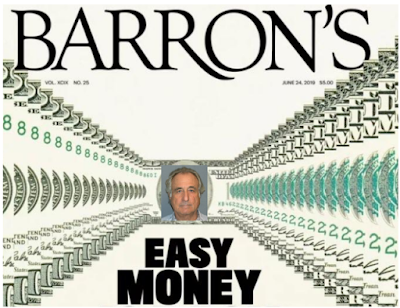

So while central banks may be out of ammo, faith in central banks is as strong as ever, compliments of imagined realities and other peoples' money:

Now, revisit the question as to whether or not the overbought casino will be supported with momentum Tech bidless.

Not long to find out:

This chart shows the overnight gaps (up and down) in the S&P 500 ETF (SPY):