"...concerns can be broken down into three key areas: deregulation of the financial sector, uncertainty in the future Federal Reserve policy, and the increased speed of the revolving door between Wall Street and Washington, D.C."

For the record, I would add:

Global trade wars

Exploding fiscal deficits conflated as "GDP"

Emerging Market meltdown

Global synchronized slowdown

Flattening yield curve

Y2K Tech stock blowoff/manic speculation

Record corporate debt to fund stock buybacks

Record wealth inequality.

He goes on to say that the too-big-to-fail banks are far larger now than in 2008. And that Trump's recent deregulation of corruption sets up a much bigger crash this time:

"By rolling back these regulations and dismantling portions of the Dodd-Frank Act, the Trump administration is removing the safety net and creating a perfect storm that could lead to a crisis even worse than 2008."

Which gets us back to the casino...

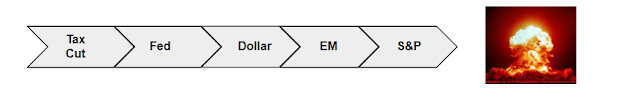

As I said earlier this week, the current top in the S&P 500 is reminiscent of 2007. This was the 2007 top:

Now, as it was back in 2007, new highs are diverging, only now they are diverging massively:

Back then, the Dow and NYSE Composite both confirmed the overthrow S&P high - as ephemeral as it was.

This time, neither the Dow nor the NYSE have confirmed. Meaning this high is even more phony and tenuous.

The article goes on to cite inflation risks.

Here I disagree. Late cycle price inflation outstripping wages is long-term deflationary. Fed tightening is deflationary. Debt is deflationary.

Therefore, unlike 2008 which had even stronger end-of-cycle inflation than what we're seeing now, the Fed is totally fucking clueless by still raising rates. Back then, by this time in the cycle, the Fed was lowering rates even though inflation was running hot at the end of the cycle:

The leading economic indicators are configured about the same now as they were at the top in 2007 i.e. rolling over.

Where things are substantially different than they were ten years ago is in positioning.

Because at the time of Lehman, gamblers had significantly rotated to cash (t-bills, money markets etc.).

This time around, amid rampant corruption, who could warn them?

"the Trump administration has a disproportionate number of top regulators from the financial industry and Wall Street."