What we are witnessing in broad daylight is human history's biggest organized crime, about to get busted in the act. Proven thieves are robbing the economy to line corporate insiders' pockets. It won't work. Sadly, the morally and mentally challenged don't see it coming...

The only thing that has changed in the past 10 years is that back in 2008 there was only one Bernie Madoff, whereas now there is an entire political party full of them. The transformation to banana republic, replete with thieving dictatorship, is now complete.

"Dallas Fed President Robert Kaplan said Tuesday he would like to see three or four more “gradual” interest-rate hikes...the shape of the curve suggests to me we are ‘late’ in the economic cycle”

The only thing that has changed in the past 10 years is that back in 2008 there was only one Bernie Madoff, whereas now there is an entire political party full of them. The transformation to banana republic, replete with thieving dictatorship, is now complete.

"Dallas Fed President Robert Kaplan said Tuesday he would like to see three or four more “gradual” interest-rate hikes...the shape of the curve suggests to me we are ‘late’ in the economic cycle”

Inter-generational theft has reached a new all time level of debauchery even by Madoff standards...

"Why didn't anyone try this sooner? What fools"

The Republican Party is now human history's biggest crime syndicate without any comparison:

"the Treasury Department expects to borrow more than $750 billion to pay its bills during the last six months of this year"

Even the White House's own rosy forecast acknowledges that the deficit will exceed 5 percent of the overall economy next year — a level it has previously reached only after deep recessions when unemployment topped 10 percent. Today, the economy is near full employment.

Anyone who actually studied Keynesian Economics would know that proper implementation calls for running deficits during recessions and surpluses during expansions. The party of tax cut profligacy runs deficits during good times and bad times. Because it's "free money".

What makes this abject irresponsibility even more amazing is the fact that Treasury yields are still lingering at 2009 recession lows. Whereas stocks have bolted several hundred percent higher based solely upon Ponzi borrowing and non-stop delusion.

The chasm between fantasy and reality has never been wider:

In other words the ignorance-fueled arrogance has reached a new all time asinine extreme.

Not only are gamblers betting that stocks are right, by a record margin, they are betting that bonds are wrong by a record margin. Talk about amazing con artists, they've convinced each other that the cycle is no longer cyclical.

Ironically, it's their very own actions of robbing the U.S. economy i.e. the workforce of vital spending power, that is their obvious undoing. Obvious to anyone with an IQ greater than a dead gopher.

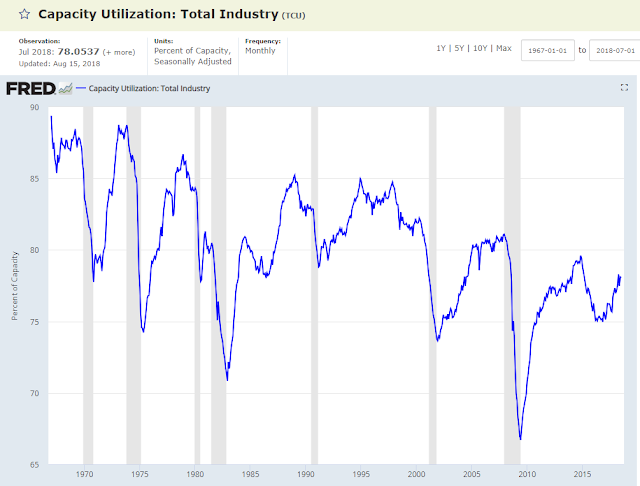

Despite a 4% fiscal deficit, capacity utilization is still lower than it was in 2015:

Despite a 4% fiscal deficit, capacity utilization is still lower than it was in 2015:

Which is why bond yields are falling instead of rising.

Based solely upon bond yields, one would have no clue that the U.S. just passed the largest tax cut in history:

Looking at speculator positioning amid declining bond yields and one can be certain that a bunch of criminals are about to get wiped off the map: