As always, arrogance the fatal weakness. Trade wars, oil wars, Fed policy error all at the same time...

Another decade of corporate Shock Doctrine has blinded Wall Street and policy-makers to the risks of late cycle "policy error", which is taking place in real-time. The Fed's flattening yield curve is pounding the global economy, banks, commodities, and yield stocks all at the same time. Fortunately, Netflix is providing a final safe haven. Today's capitalist bailout queens are ignoring markets. That will be their undoing.

Another decade of corporate Shock Doctrine has blinded Wall Street and policy-makers to the risks of late cycle "policy error", which is taking place in real-time. The Fed's flattening yield curve is pounding the global economy, banks, commodities, and yield stocks all at the same time. Fortunately, Netflix is providing a final safe haven. Today's capitalist bailout queens are ignoring markets. That will be their undoing.

This has all been a process of annihilation...

"...The economy especially in the US was about to finally live up to the unemployment rate, the hysterics claimed, which meant an explosion in wages therefore inflation, and finally Jerome Powell's confidence to go faster and farther with the federal funds rate. All these things were to produce an epic, biblical BOND ROUT!!!!"

"The flattening of the yield curve was a loud if partial rejection of that thesis. This was ignored partly because of blatantly dishonest economic commentary and partly plain economic illiteracy. And when it comes to financial curves, the dearth of understanding them is near total."

One thing Wall Street and Fed have in common is that they believe they are smarter than reality. Unfortunately, the yield curve is not only right as always, but this time it's inflicting far more damage than it would normally. Especially to banks...

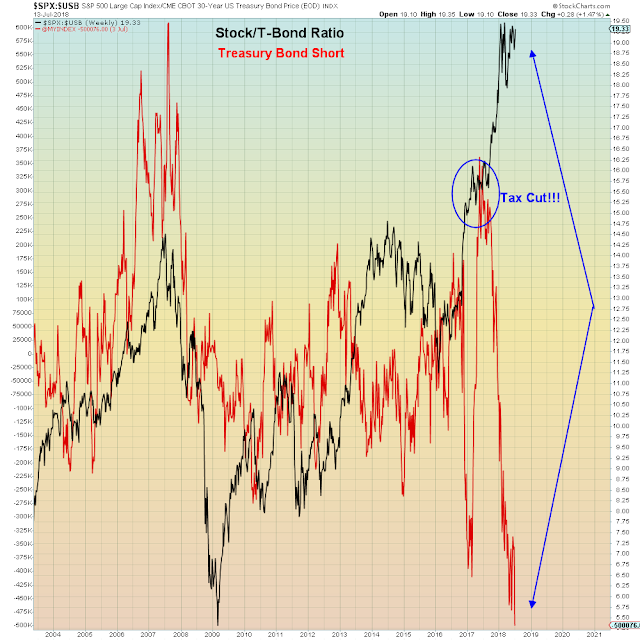

By ignoring the yield curve, the Fed is over-tightening which means they are decimating yield plays, commodities, Emerging Markets and ironically now even banks. Normally Financials benefit from higher interest rates, however, when long-term rates stop rising due to economic deflation, the bank rally ends.

Aside from three Tech stocks leading the market, there is no support, as late cycle Energy plays get crushed by Oil Wars 2.0.

As we know, the yield curve is merely the spread between long-term and short-term rates. Here we see why this cycle is "different" because long-term rates never rose as the Fed tightened. There was too much slack in the economy due to another decade of outsourcing:

Here we see why this cycle is different than previous cycles. In this cycle wages never kept up with the general CPI. It was a deflationary cycle from the beginning, predicated upon mass layoffs to fund stock buybacks:

"More free money!!!"

"More free money!!!"

Copper confirms this analysis: in the prior cycle, copper peaked at the end of the cycle, this time it peaked seven years ago:

What used to be considered a recession is now the best con job 100% borrowed money can buy:

"Then the economy retired"

Where this all affects markets is in the Fed over-tightening, which first afflicted yield plays:

But now afflicting the entire planet...

Putting it all together, those who are saying that the yield curve can be ignored indefinitely, are ignoring what banks are saying. The last time the yield curve inverted, banks continued to rise, however this time banks have already rolled over prior to outright inversion:

Putting it all together, those who are saying that the yield curve can be ignored indefinitely, are ignoring what banks are saying. The last time the yield curve inverted, banks continued to rise, however this time banks have already rolled over prior to outright inversion: