HODL: A bastardized version of "hold": "originated in a December 2013 post on the Bitcoin Forum message board by an apparently inebriated user who posted with a typo in the subject, "I AM HODLING"

Stop me any time.

What is more than clear is that today's zero sum Idiocracy doesn't understand the concept of sell. Not just in Bitcoin mind you - in anything. This is all compliments of brainwashing by the financial services industry. To say that it will end up in mass financial burial is a tremendous understatement.

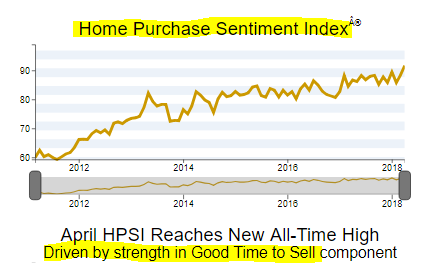

Today's case in point is real estate. Here we learn that confidence in future prices has NEVER been higher.

"Those who think home prices will move even higher rose the most"

But why do people think that?

"High home prices and good economic conditions helped push the share of Americans who think it's a good time to sell to a fresh record high"

Only the share of those who think it's a good time to buy, fell"

You can't possibly make this shit up

One thing we know with absolute certainty is that the record number of people who believe house prices will go up, will be shocked when they don't. It goes back to what I've been saying about bubble reflexivity - people are oblivious to the fact that they themselves ARE the bubble.

This sums up the Idiocracy's understanding of markets. The greatest likelihood of rising prices is when sellers are going up and buyers are going down:

This sums up the Idiocracy's understanding of markets. The greatest likelihood of rising prices is when sellers are going up and buyers are going down:

Red line

The data only goes back to 2011, but we see that net buyers peaked at the low in prices in 2012, and since then net buyers have plummeted to cycle lows, as prices climbed.

Everyone thinks that they are smarter than everyone else, even though they are everyone else...

Likewise, consumers are most confident when they have no more money to buy things:

Getting back to the casino, it appears that Warren Buffett's weekend confab kept the fire burning under Apple early this week.

Deja vu, the casino has been oscillating between the 50 day and 200 day for two weeks now. Early in the week, it tags the top line and then by mid-week it re-tests the bottom:

This oscillation is deja vu of 2015

What is also deja vu is Apple rallying while Apple suppliers roll over. And why "no one" sees it coming:

What is also deja vu is Apple rallying while Apple suppliers roll over. And why "no one" sees it coming:

Both Pegatron and Hon Hai -- Apple’s principal assemblers -- reported net income falls in 2017 even as their biggest customer racked up record profits... there’s no guarantee Apple hardware partners can share in the spoils, given the U.S. company’s reputation for squeezing suppliers to preserve its own margins"

Remember to be shocked when you hear that Emerging Markets are becoming a problem all over again. Another Black Swan event - no stoned zombie saw it coming.

ZH: The Best Indicators For EM Contagion

"how can one decide if the Emerging Market turmoil is about to sweep across the entire sector, and result in DM contagion?"

"...at a time of peak EM debt/equity inflows ($371bn)…EMB below 107.50 = contagious"