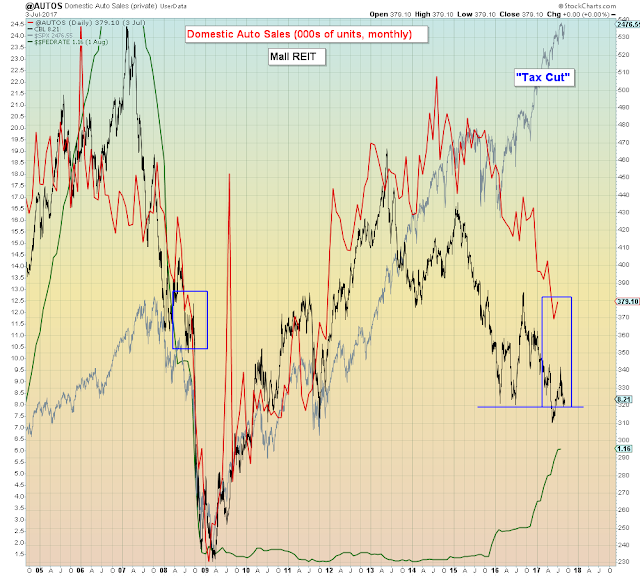

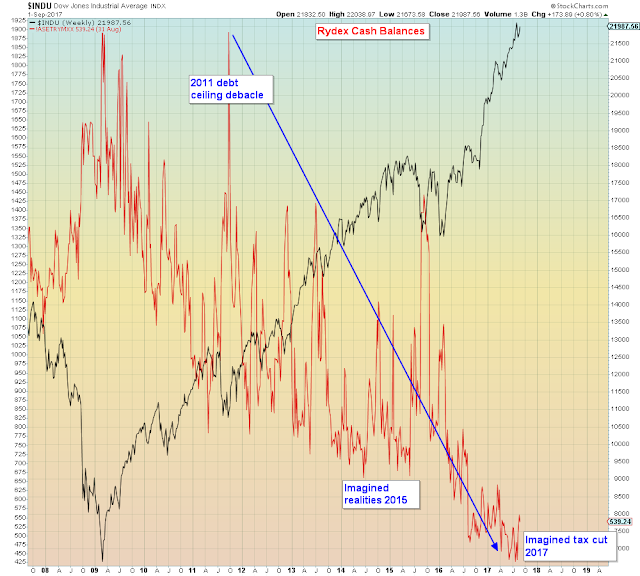

Contrary to ubiquitous belief, raising interest rates at the end of an eight year debt binge offset by a fake-believe tax cut, is not "reflationary". The Fed has successfully killed another recovery. They are batting 1000 since WWII...

Nevertheless, this is the narrative that the average dunce has been sold by their "trusted" advisors...

"Paulsen expects inflation will become a bigger and bigger focus. Plus, he said bond yields will trend higher — hence changing the market's character."

Paulsen is telling investors to ride the rest of the bull market by buying "overheat economy" sectors.

"I would prefer to look at the industrials, materials, energy, technology and then the financials"

To say that this is going to be painful is an asinine understatement