ZH: Barclays: "Hurricane Irma's Insured Damage Could Be The Largest Ever"

Adjusted for inflation, all except one of the the costliest hurricanes in U.S. history came in the past 15 years. Two of course are coming two weeks apart, costs are estimated for Irma and Harvey. Based on the above headline, total costs for Irma (including taxpayer costs) could be substantially higher:

Aside from the direct cost of denialism, herein lies the problem:

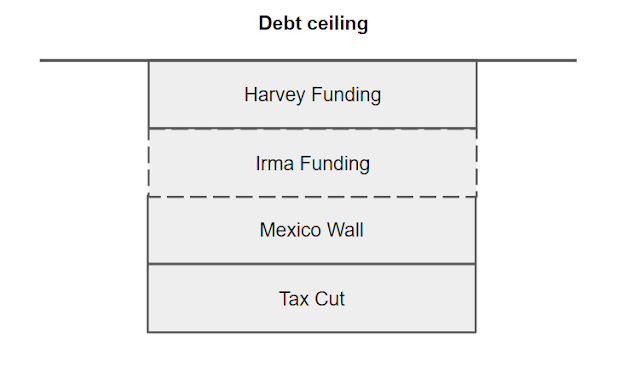

For the least competent president in history, navigating the imminent fiscal cliff is getting harder by the weather forecast. Since he boxed himself in by saying that he would shut down government over the wall, the costs of hurricane relief have skyrocketed. How he manages to navigate this imminent financial debacle remains to be seen.

Meanwhile, gamblers are not waiting around to find out:

Emerging markets got pole axed today which means downside momentum is just getting started:

Crude oil was the "bright spot", backtesting the downtrend line, deja vu of 2015:

Banks shellacked below key support:

Skynet defended the 50 day at all costs. Vix backtested the downtrend line:

In summary, "risk parity" is on the verge of rebalancing back to bonds:

Futures are retracing in three waves. The U.S. sold hard when Europe closed. We'll see if the favour is returned:

This past weekend I said that the Fed had imploded yet another 'recovery'. One day later, we've received confirmation:

CNBC: Fed Brainard Admits They Fucked It Up

Oh well.