Due to the absence of a real economy consisting of both supply and demand, Global Central Banks used asset inflation to simulate economic reflation. The end result is a global con job of an epic scale. Gamblers are merely responding to the muscle memory of where the economy used to be, via the unprecedented misallocation of capital...

But first, the biggest volatility collapse in casino history is attended by the biggest bets on further volatility collapse in casino history. What else?

via ZH: Dead Market Walking

Herein lies the problem, by engineering fake reflation via asset price levitation, global Central Banks have driven a chasmic disconnect between asset values and economic reality. They tried this already in the period 2009-2011, and that crash was vertical since the rotation from cyclicals is always back to bonds. Once cyclicals become overbought, and every other sector is played out, there is nowhere else to go.

What was once considered a recession is now considered peak recovery.

Supply-Side Dumbfuck-o-Nomics:

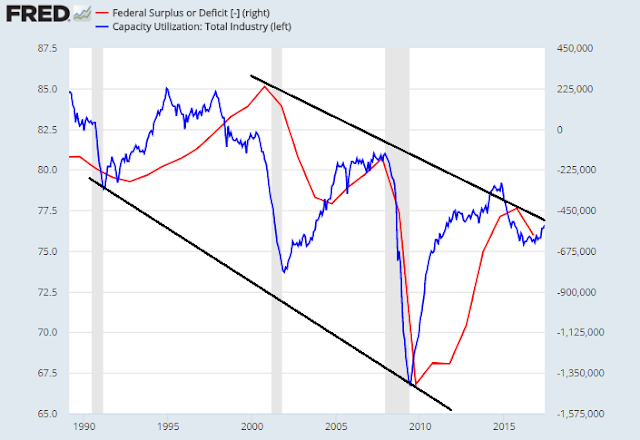

U.S. budget deficit (red) with capacity utilization (blue)

Below, I separate out this latest cycle's bubbles as to whether or not they've rolled over or are still at new highs:

New Highs:

Bitcoin

Emerging Market Stocks

Financials

Fintech

Defense/War stocks

Apple

Inverse volatility

Rolling over:

FANG stocks

Oil

IPOsSmall caps/banks

High beta cyclicals: Transports, Energy

Revenueless Biotech

Chinese Internet

Ethereum

Getting back to the last cyclical asset inflation masquerading as economic reflation, 2009-2011, gold was the alternative currency "safe haven" du jour. In this cycle it's Bitcoin, protecting us from non-existent inflation by going parabolic:

In addition to record low cash balances, record bets on low volatility, and crowding into the junkiest assets gamblers can find, gamblers have just increased their bets that OPEC's productioncut increase will boost oil prices:

So when I say that this time will be painful, of course that is an asinine understatement.

ZH: New Brokerage Accounts Highest Since DotCom Bubble

Getting back to the last cyclical asset inflation masquerading as economic reflation, 2009-2011, gold was the alternative currency "safe haven" du jour. In this cycle it's Bitcoin, protecting us from non-existent inflation by going parabolic:

In addition to record low cash balances, record bets on low volatility, and crowding into the junkiest assets gamblers can find, gamblers have just increased their bets that OPEC's production

So when I say that this time will be painful, of course that is an asinine understatement.

ZH: New Brokerage Accounts Highest Since DotCom Bubble

Of course the biggest misallocation of capital of all is to the countries that were promised a middle class, but never got one. How could they export anything but deflation?

The Faustian Bargain after 2008, was forgetting the Faustian Bargain

"What do you mean there's been no recovery"