But don't take my word for it:

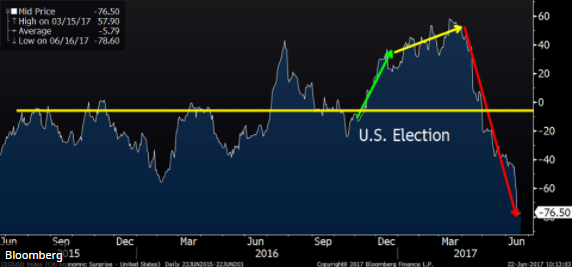

The Citi Economic U.S. Surprise Index, which measures data surprises relative to market expectations has gone from mildly curious to a real concern. The Treasury market has been most closely correlated to this index as bond yields have declined along with the disappointing data. Equities have been able to ignore this data, but the question is for how long?

Citigroup's Economic Surprise-You're-a-Fucktard Index

ZH: Current Version Of Senate Healthcare Bill Is DOA

Rand Paul and his fellow RepubliCons don't like the bill because it doesn't go far enough. Surely we can find a way to strip coverage from at least 50 to 60 million working people.

Bulls going ALL IN on the non-news garnered a key reversal in Biotech today:

Crude "bounced back" .5% today after a -23% decline:

Junk bonds are just starting to wake up to reality:

The REAL recession trade is on in full force. The one where holding Colgate is not deemed safe enough...

Banks held the 50 day moving average (barely)

Amazon held $1,000 for the second day (not shown)

The S&P closed weak right at the election trend line on decade low volume...

And of course, the jackass-in-chief admitted that he bullshitted about taping his Comey conversations

The joke is on the people who believe this tool:

"Any moron can see that the drilling and energy sector is way up"