But first...

Any questions?

The MacronNomic-inspired trade du jour is shorting volatility amid the tightest trading ranges in 75 years. Because what could go wrong?

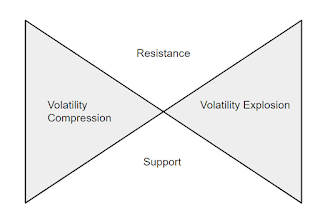

By definition, volatility is mean-reverting, since trading ranges can only compress so much before they begin to expand again, and considering that volatility is at a 75 year low, that could be "soon"...

On Friday, the major U.S. averages closed at new all time highs, compliments of the tightest trading ranges in 75 years. Apple was the leading mega cap stock, powering the averages. Leave aside the collapsing U.S. macro data, the forward earnings implosion, the commodities meltdown, and the decline in iPhone sales. This morning, post-Macron, it's deja vu all over again.

The trade of the day is "volatility compression", however, when it unwinds from all time highs, it will get fugly...

When the trend line breaks...

Tech

Europe has left the building...

One stock to go...The biggest one:

"We only need one stock anyways"

Bonus chart:

China