"This tax cut will be bigger than both of my hands put together"

Meanwhile, as we recall, the Brexit implosion lasted ~3 days before it got bought with both hands. After Trump, the dip got bought before the U.S. even opened. This time, gamblers bought the French election ahead of time vis-a-vis the second biggest short-covering rally in four months.

Suffice to say, markets are at a critical juncture and it's not clear what "good news" will come out of this initial vote to generate further risk appetite that lasts longer than a short-covering rally...

The chart of the week is Oil. This latest downleg is so far identical to the prior one, but somewhat less likely to stop at the support line this time.

US Oil ETF

WTI Crude Future contract

The trend line has been defended six times in the past year, however this has been by far the shortest bounce:

Following last Friday's earnings fiasco, big banks fell hard this week and then enjoyed a three wave bounce off of prior support:

Close-up view

Rates decoupled from stocks and then bounced at the end of the week:

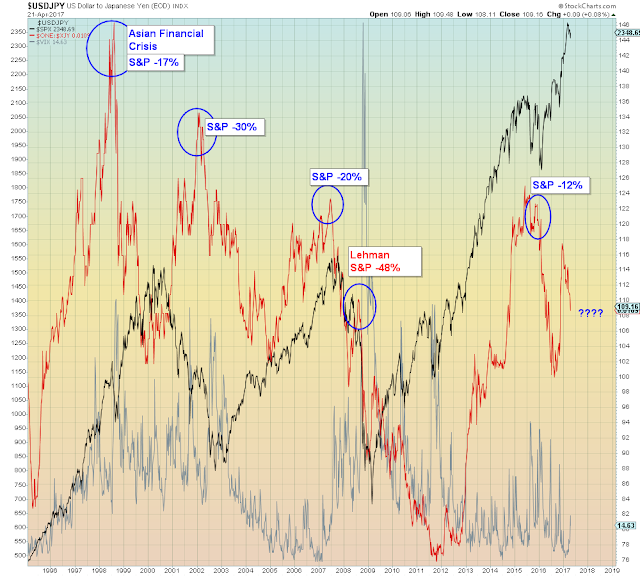

USDJPY traded 1:1 with U.S. stocks

All very bullish of course

The US Dollar ended back at critical life support, which has been tested four times since the election:

Commodities broke the support line today, going back one year:

Money (out) flow from the S&P was bad all week featuring strong opens and weak closes:

Bueller?

% of stocks above 50 dma

Nice backtest:

Unlike the last two referenda on Globalization when the market was oversold going into the votes, the market is overbought this time:

The Nasdaq made a new closing high this week compliments of Facebook

Nasdaq with realized volatility

ZH: European Stocks Have Priced In Zero Risk