Throughout the Supply Side indentured servitude era going back almost 40 years now, the cost of capital has declined inexorably lower, as the legacy industrial economy was liquidated for special dividends. That was everyone's clue that the *Free Trade* theories of the day were not free, they would inevitably cost everything. However, in between the highs and lows of boom and bust, we live in the Twilight Zone of plausible deniability and non-stop bullshit.

Historically, interest rates were used to bring down inflation, however, that relationship has been inverted whereby interest rates are now used to create inflation, because there is ever growing slack in the economy.

Here we see the Fed rate has been LOWER than the CPI for eight years straight, meaning a negative cost of capital. The Fed is subsidizing overinvestment in excess capacity...

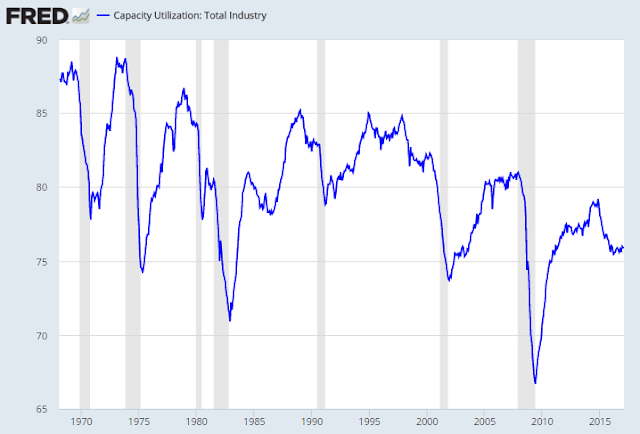

Why? Because the current level of capacity utilization used to be called "recession":

Economists are incapable of admitting their own mistakes so they stick to their linear text book theories which state that increasing productivity via automation and outsourcing ALWAYS benefits the economy. Unfortunately, the declining interest rate was their clue that there was intellectual leakage to their academic theory as it was applied in the real world.

That leakage pertains to the accelerating turnover rate of skills, investments, and indeed human beings in this *new* economy resulting from obsoleting these investments and people before they have paid back their initial return on investment. For example, someone pursues a skill or degree and yet is made "redundant" prior to paying off the loans and labour associated with acquiring that skill. As the cost of capital has declined inexorably lower, the "churn" has accelerated because investments in automation have become cheaper. According to the discounted cash flow model, a 0% interest rate implies an "infinite" return on investment, assuming the economy doesn't collapse in the meantime. The deleterious effects of this churn rate are highly evident in debt accumulation, wage stagnation, unemployment, poverty and divorce. Not necessarily in that order.

We now have an economy consisting of supply and debt versus supply and demand. Papered over of course by "exploitation bias" - the willingness of the ultra-wealthy beneficiaries of this model to consistently paper over the costs.

Nevertheless, the cannabilization of the status quo continues to accelerate under the guise of "change".

They still haven't figured out where this type of "change" leads.

A negative cost of capital leads to overinvestment in collapse...

A negative cost of capital leads to overinvestment in collapse...