But first, add Australia to the list of countries Trump has pissed off...

This was the week of short-covering compliments of the BOJ, Fed, Bank of England, and tomorrow's jobs report...

Jobs report days are usually big rally days, however, if the count is correct, any gap up above the trend-line will be a headfake...Monday's gap is still open (left of 'BOJ'):

According to this article, January is the most volatile month for jobs predictions:

"Total nonfarm employment is expected to increase by 175,000, according to Reuters"

"observers' hopes for a solid month of job growth were buoyed Wednesday when payroll processor ADP reported 246,000 new workers...ADP's report was a positive sign, but it's no guarantee that the BLS will have similar numbers. The two reports employ different methodology"

"Januaries with new administrations entering office have actually seen an average net loss of around 4,000 jobs on average."

Volume has been coiling

VIX shorts hit a record high this week while the VIX hit a 10 year low yesterday

Throughout this final rally smart money has been selling

TRIN

Of course, we already knew that...

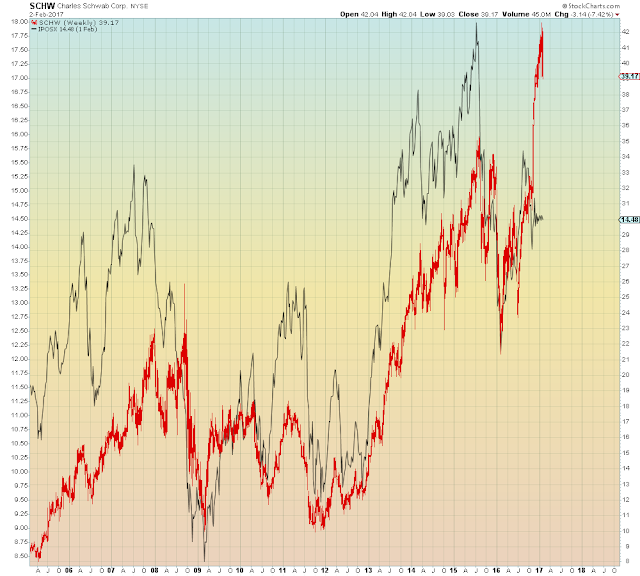

Banks and Brokers have rolled over deja vu of 2008

Schwab with IPOs

With Banks and Energy rolling over, big cap tech is the last thing holding up the market...

QQQ/DOW ratio:

Amazon which was the last mega cap tech stock to report, just imploded after hours on a revenue miss. To date, Apple, Google, Microsoft, and Facebook have all rolled over...

In other words, there goes the ENTIRE retail sector compliments of Trump:

"What do you mean there's no such thing as a jobless consumer?"

Amazon and Sears

Post-jobs report, I think Trump will get his way with the weaker dollar...