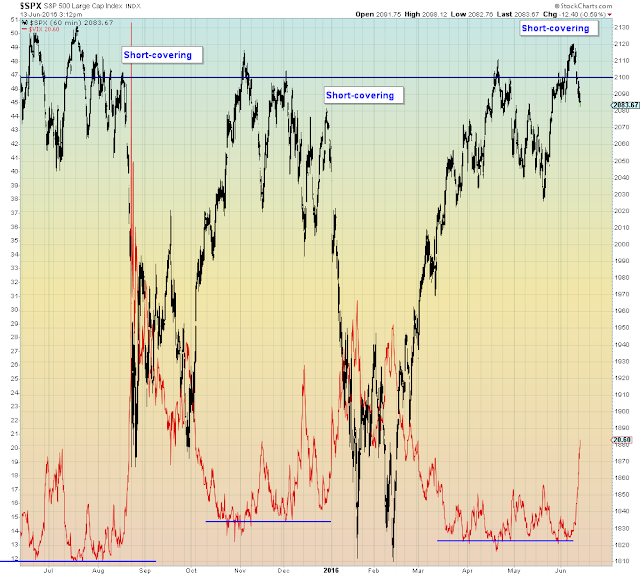

In a way that could only monkey hammer Team Groupthink with maximum impact, Wall Street covered ahead of the Fed this week. Overnight risk from Asia and Europe is at maximum. All risk assets are aligned to the downside. And the VIX is screaming higher at a pace not seen since last August...

It only took two months of Yuan devaluations for the stoned zombies to finally notice...

It only took two months of Yuan devaluations for the stoned zombies to finally notice...

And the takeaway from this article citing August Deja Vu:

"I think the technicals are telling you that you're set up for a surprise to the upside and a break out,"

What else?

The Scylla and Charybdis

Recently, I said that either the PBOC will devalue the Yuan OR, they will defend the Yuan by selling dollars which will monkey hammer Yen carry traders. Last night, both occurred at the same time, as USDJPY (below) fell and the Yuan weakened (not shown):

Today in the day session U.S. algos helped themselves to a big pile of free money to stave off S&P implosion, but that barely dented the overnight decline...

Today's volatility explosion was due to a number of 100% correlated factors already mentioned in the prior post, however, I would point out that the always trusty, low volatility implosion fund rolled over as well:

Speaking of dumb beta...

And more dumb beta: Berkshire Hathaway HAD to tag that downtrend line one more time today and then gave it all back...

Kiss goodbye:

3x leveraged oil was bid in the morning, backtested the rising wedge and then closed on the lows...

3x leveraged oil was bid in the morning, backtested the rising wedge and then closed on the lows...

I wouldn't call this a gap 'n crap so much as a reluctance to hedge in front of the Fed, hence more of a Blind Swan dive into pavement...

And if you are an Elliott Wave purist, then you win, because there is only one chart needed to explain all of the above...

Global Dow: Third wave down at all degrees of trend now in progress...