Well it "only" took ten years, but the world is finally waking up to the reason I created this blog ten years ago - Globalization is a colossal failure. Yesterday, Trump and Sanders both came out against Globalization and *Free* Trade.

"During my campaign for the Democratic presidential nomination, I’ve visited 46 states. What I saw and heard on too many occasions were painful realities that the political and media establishment fail even to recognize. In the last 15 years, nearly 60,000 factories in this country have closed, and more than 4.8 million well-paid manufacturing jobs have disappeared. Much of this is related to disastrous trade agreements that encourage corporations to move to low-wage countries. Let’s be clear. The global economy is not working for the majority of people in our country and the world. This is an economic model developed by the economic elite to benefit the economic elite. We need real change."

This is where it gets "interesting"...

For the record my money has been 98% invested in cash (money markets) for the entire past decade. In other words, I eat my own dog food, and I bear no illusion that any asset is 100% safe right now. I say this only because Globalization is the LAST bubble, and it's imploding in real-time. While latecomers write wistfully of political and economic change, that very change is happening right in front of their faces faster than anyone can even acknowledge. European banks are below Lehman levels, currencies are out of control, profits are at recession levels, payrolls falling off a cliff, deflation out of control, oil re-imploding, global bear market. This imploding clusterfuck is not going to wait for an election to bring the kind of "change" that the de facto political establishment has no intention of ever carrying out, under the status quo.

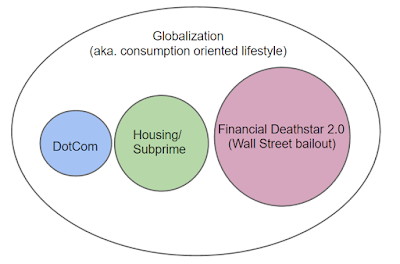

This last bubble is inflated solely by entitlement and delusion:

Way back in 1929 when that bubble imploded, it took 25 years until 1955 for stocks to regain their prior highs. That generation never owned stocks again in their lives. My grandparents never owned stocks and never borrowed money. In the past 15 years, as we see above, we have had three bubbles each separated by a "V" shaped bottoms. These "instantaneous" stock market recoveries have conned the sheeple into believing that stocks should be held through thick and thin. What they fail to recognize is that each recovery, represented by the Fed Funds rate (red line) has been weaker and weaker. Meaning that more and more people have been going under the bus with each iteration of CasinoNomics.

And this is the last iteration.

"Could this rejection of the current form of the global economy happen in the United States? You bet it could."