This one chart (below) in a nutshell shows why today's EconoDunces are drawing the inversely wrong conclusion from the "data". They look at the yield curve which is the spread between long term and short-term bond yields as an indication of recovery. As we see below, at the peak of every prior cycle, the two rates converge as Fed policy drives short-term rates up to long-term rates. However, in this cycle, the yields are converging because long-term rates are falling while the Fed is "talking up" short-term rates with incessant bullshit.

I was trying to find an "indicator" to express this historically colossal delusion. And I just found it: Correlation, lower pane. In a nutshell, the long-term bond market doesn't believe in this fake recovery, but the Fed is forcing correlation via policy. Note that back in 2006, the bond market didn't believe in Bush's fake recovery either, but was forced to believe by Greenspan's 17 rate hikes, which converged long and short-term rates until the wheels came off the bus soon after...

CPI with Fed Funds rate

Which of course gets us back to the chart of the week...because mass layoffs and imported deflation aka. poverty is driving U.S. bond yields inexorably lower, which in turn is weakening the dollar and Yuan versus Japan.

-19%

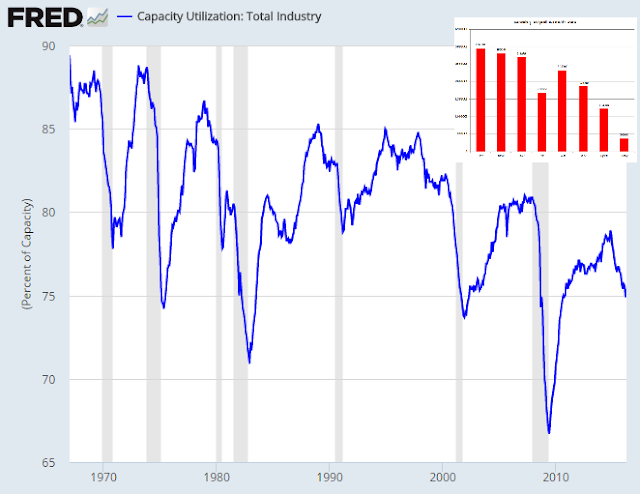

Mass layoffs to fund stock buybacks and temporarily increase profits = Reduced Capacity utilization = 0%

Which in turn will implode the S&P.

Deflation with S&P:

Long-term Treasuries are converging on 0%

But we've only seen this movie twice before, so don't tell anyone the ending...