This all hinges on the "low" volatility binary explosion fund which rolled over this week from a fifth wave overthrow:

Gamblers are primed for the shitting of bricks:

Cash Balances (Rydex)

There's been a lot of talk recently about volatility positioning due to the record shares outstanding in the volatility ETFS (VXX, UVXY, TVIX etc.), however, no one knows if that is long or short.

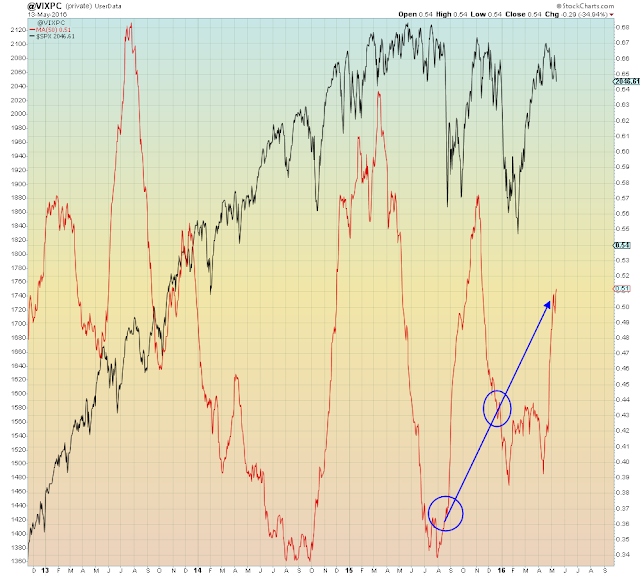

This is the CBOE VIX put/call ratio (50 dma). Gamblers are currently shorting volatility because they didn't learn their lesson in August and January:

Leaning the wrong way visualized:

Why hedge?

Put option volume

Treasury yields aka. 'Conomy

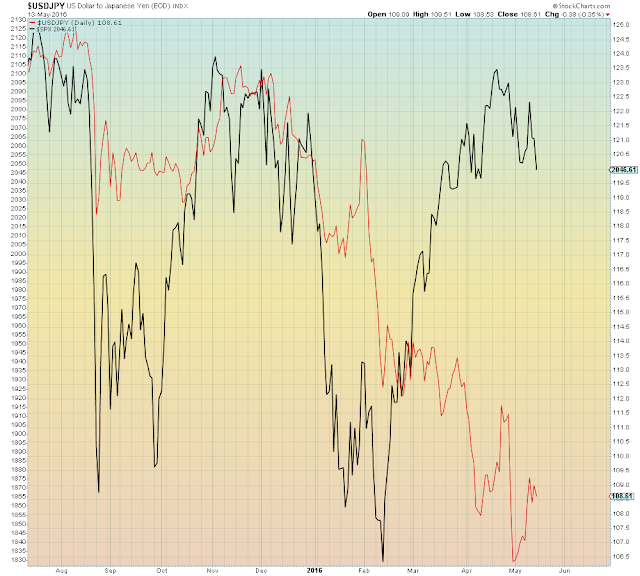

JPY

Price / volume

Volatility

Breadth momentum

% of stocks above 50 dma

Money Flow

Growth / value ratio

Emerging Markets

Chinese Yuan

Chinese Stocks

World ex-U.S.

U.S. Deflation (TIP/Treasury ratio):