Ludwig Von Mises:

‘There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.’

This just in:

"China’s home-price gains accelerated last month as the nation’s economic hubs such as Beijing, Shanghai and Shenzhen continued to lead the way amid surging liquidity that underpinned demand."

China's commie capitalists are now doing for the economy what they did for their stock market last year:

China has been strengthening its currency in a vain attempt to shake short-sellers. To that end, the currency has gained a miniscule 2.1% since January. This is the epitome of cutting off their nose to spite their face, since currency strengthening reduces the supply of Yuan, which is a de facto monetary tightening, hastening implosion. So it can come as no surprise that the currency is now once again following "Risk" lower.

CNY/USD (red) versus CNY/JPY:

Also no surprise, last Thursday, China's Capitalist Central Planners reverse engineered a GDP figure that appeased markets.

Because it's a sad joke that China smoothes its GDP, the way Bernie Madoff smoothed his returns:

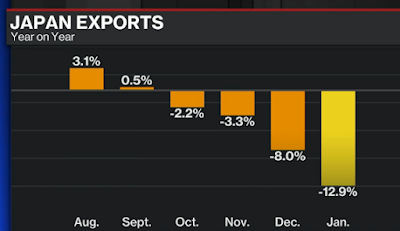

Therefore, to see what is really going on in China, we have to look to the surrounding countries:

BBG: Feb. 17, 2016

This just in...

This also just in: