Obama: "Those who speak of economic decline are peddling fiction"

"When the Idiocracy learned that printing money to buy stocks was not the secret to effortless wealth, they were shocked and outraged. Because no one told them."

Stocks with Fed balance sheet and interest rates

The history books will say that Obama presided over the first non-recovery in U.S. history. He turned a blind eye to the post-9/11 corporate Shock Doctrine that began under George Bush. In Obama's case, sadly Lehman was the excuse to give corporations carte blanche, while comfort-seekers remained in the fetal position amid 8 seasons of American Idolatry...

But first, copious dullards will lose everything believing lies told by serial psychopaths...

Before I go point by point, this chart best captures Obama's legacy:

Obamanomics

Foodstamps and the employment-population ratio:

Point 1 from the article:

Employment falls most since 1980s (see above chart).

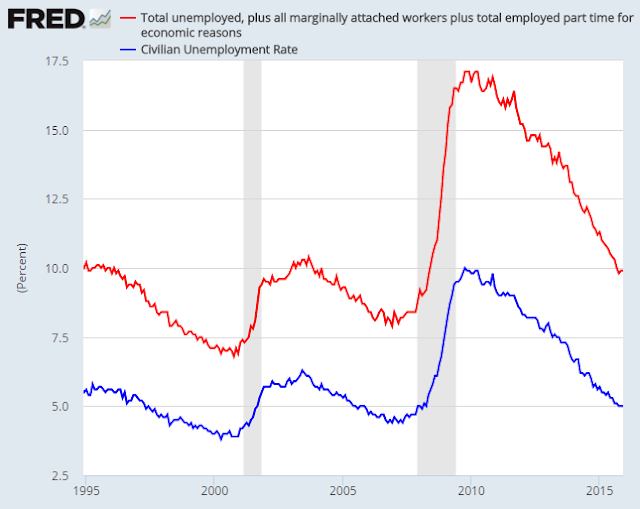

Only by removing the long-term unemployed from the official (U3) unemployment rate, did Obama achieve this sleight of hand.

The true unemployment rate (U6) is still 10%, double the "official" lie:

Far worse yet, most of the jobs that were created were low wage part-time jobs, which are still at recession levels:

Point 2: "Market prosperity has been built on a solid economic foundation"

See rest of blog. Democracy only works when the citizens and media are not as corrupt and dumb as the politicians. Otherwise, all bets are off.

Obama presided over the first non-normalized pseudo-recovery in U.S. history. Non-normalized with respect to both Monetary and Fiscal policy.

GDP growth - debt growth. All of Obama's "growth" was borrowed money:

Point 3: U.S. companies are investing at a record pace

BBG Oct. 6, 2014

CNBC Sept. 2015

"Investment in fixed assets is at a 60 year low"

Point 4: American companies have stronger balance sheets than ever before

CNBC Oct. 2015

BBG Nov. 2015

Leveraged loans:

Junk bonds

Stocks divided by debt and inflation with labor participation rate: