The Chinese government is a one legged man in an ass kicking contest...

0% interest rates has had two major effects:

1) It discouraged long-term investment in the real economy because there was no real rate of return

2) It incentivized extreme speculation and gambling i.e. zero sum capital gains versus income, as one asset class after another got pumped and dumped...

Nowhere to hide:

All risk asset classes have peaked:

Consider this in the context of China now trying to "help" the economy by lowering interest rates:

“Although China has cut interest rates many times recently, steel mills said their funding costs have actually gone up.”

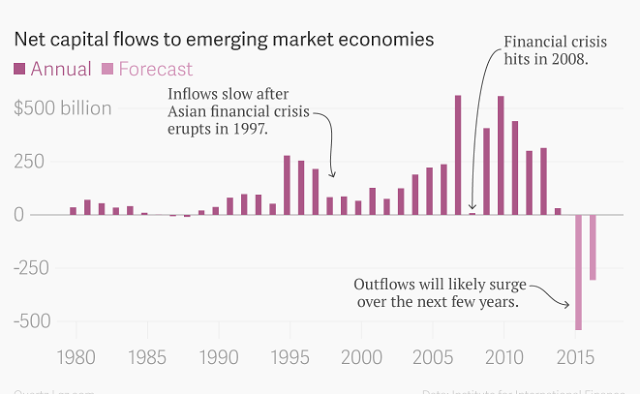

Why? Because lowering interest rates has caused capital to flow out of the country at an unprecedented rate. Meanwhile capital flight from China means capital flight from the U.S. as the Chinese government repatriates capital to defend the Yuan currency peg to the dollar.

Well, at least the stock markets are "decoupled". From reality: